Rude Health – Sports Nutrition M&A

sECTOR oVERVIEW – SPORTS NUTRITION

Like a gym-obsessive’s biceps, the global sports nutrition market is anticipated to expand at a compound annual growth rate of 9.7% to reach $24 billion by 2025, according to a report released this month by Grand View Research. The post-workout water and banana are for losers. Proper athletes’ kit bags are now stuffed with increasingly sophisticated gels, powders and bars for consumption before, during and after exercise.

This trend has not been lost on cash-rich acquirers. Associated British Foods plc, owners of Jordan’s and Dorset cereals, entered this market with the acquisitions of HIGH5 and Reflex Nutrition. Walgreens Boots Alliance, the retail pharmacist, acquired the Protein Works. Never ones to miss out, private equity muscled in when Lion Capital, former owner of Kettle Chips and Weetabix, completed the acquisition of Grenade.

Smaller acquirers have also been involved. Science in Sport, the AIM-listed sports nutrition brand, doubled in size following its acquisition of premium protein brand PhD. Samworth Brothers, the Leicestershire-based owner of Ginsters and Melton Foods, added SCI-MX Nutrition to its stable.

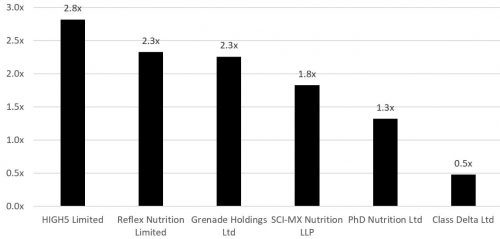

Acquisition multiples have ranged from 0.5x revenue for The Protein Works to 2.8x revenue for HIGH5. Although the sample is small, the trend has been positive, with multiples appearing to expand over time, a pattern that has been in evidence in the broader food and drink M&A market.

Just like its product proponents, the sports nutrition sector is bulking-up and appears to be in rude health.

Chart: UK Sports Nutrition Revenue multiples M&A.