Valuation pressures feeding through to startups? Not yet.

Tech sell-off

Tech-heavy stock market indices are looking at serious losses in the year to date. The FTSE AIM All-Share and the Nasdaq are both down 25% since the start of 2022. Other good proxies for the desirability of technology companies, such as Scottish Mortgage, a £12 billion investment trust, remain off 35%, having been down year-to-date by 48% at one stage.

Increasing fears of a recession are dampening growth expectations, rampant inflation is putting pressure on operating expenditure, and rising interest rates translate into a soaring cost of capital. This combination is translating into lower revenue guidance, thinner margins and more aggressive discount rates on future earnings. It makes sense that the public markets have adopted a bearish stance on the technology sector.

Despite this, UK startup valuations remain resolute. We looked at how early-stage pricing has trended in the first half of 2022 – the results are surprising.

Buckets

When analysing tech valuations in the private markets we look at the pre-money valuations of companies undergoing a fundraising event. This gives us a real-time picture of how investors are pricing companies. Rather than looking at this data in aggregate, we segment our sample into categories based on cheque size. Our categories are as follows:

Friends & Family – fundraisings of up to £250,000

Pre-Seed – £250,000 to £1 million

Seed – £1-3 million

Series A – £3-10 million

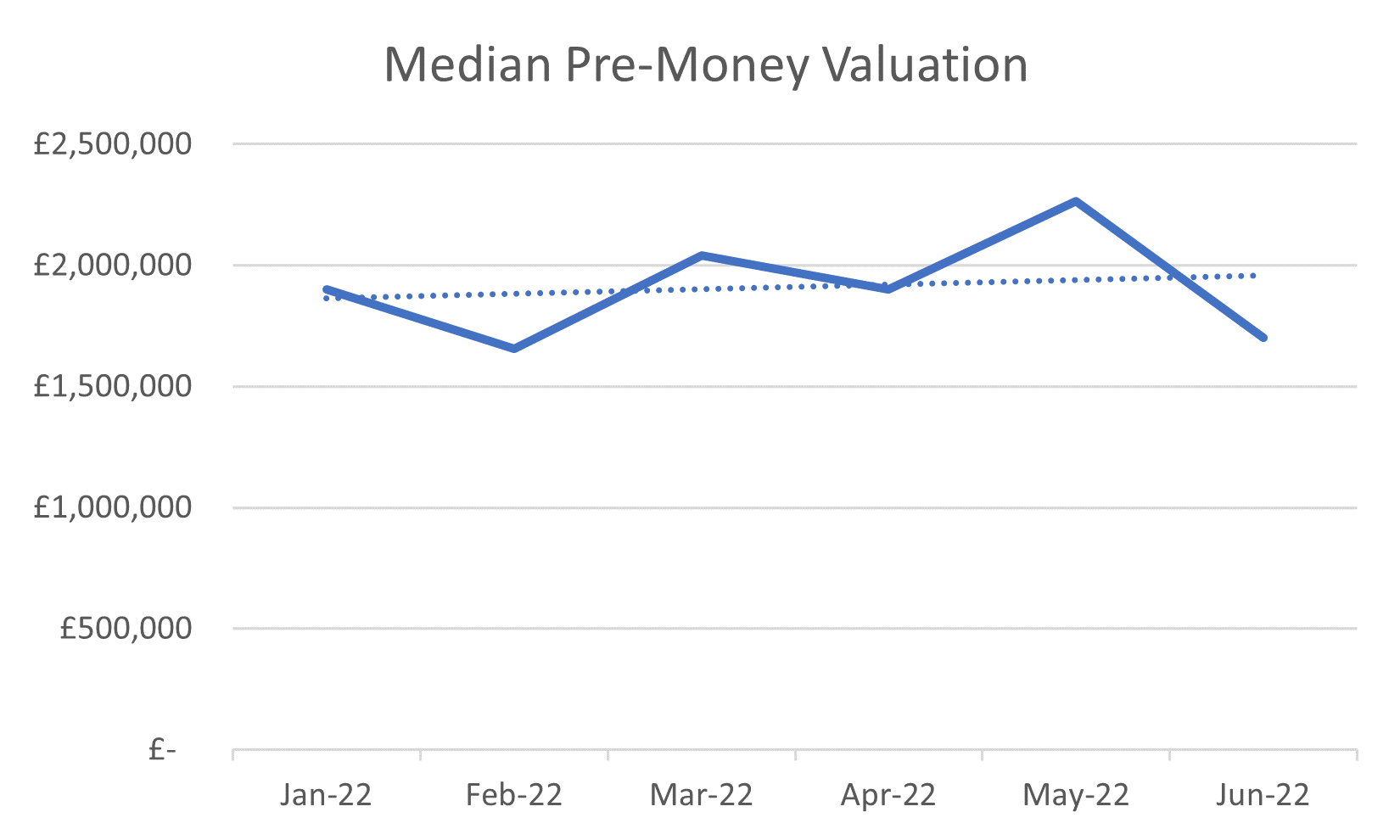

Friends & Family

The smallest fundraises typically involve a handful of ‘friendly’ investors who are close to the entrepreneur. The companies themselves may be little more than conceptual, offering nothing in the way of fundamentals to support a valuation. Value at this stage falls into the ‘hope’ category. Our trend line (the dotted blue line) suggests a small increase in median pre-money valuations over the past 6 months, albeit a fall in June back to January/February levels.

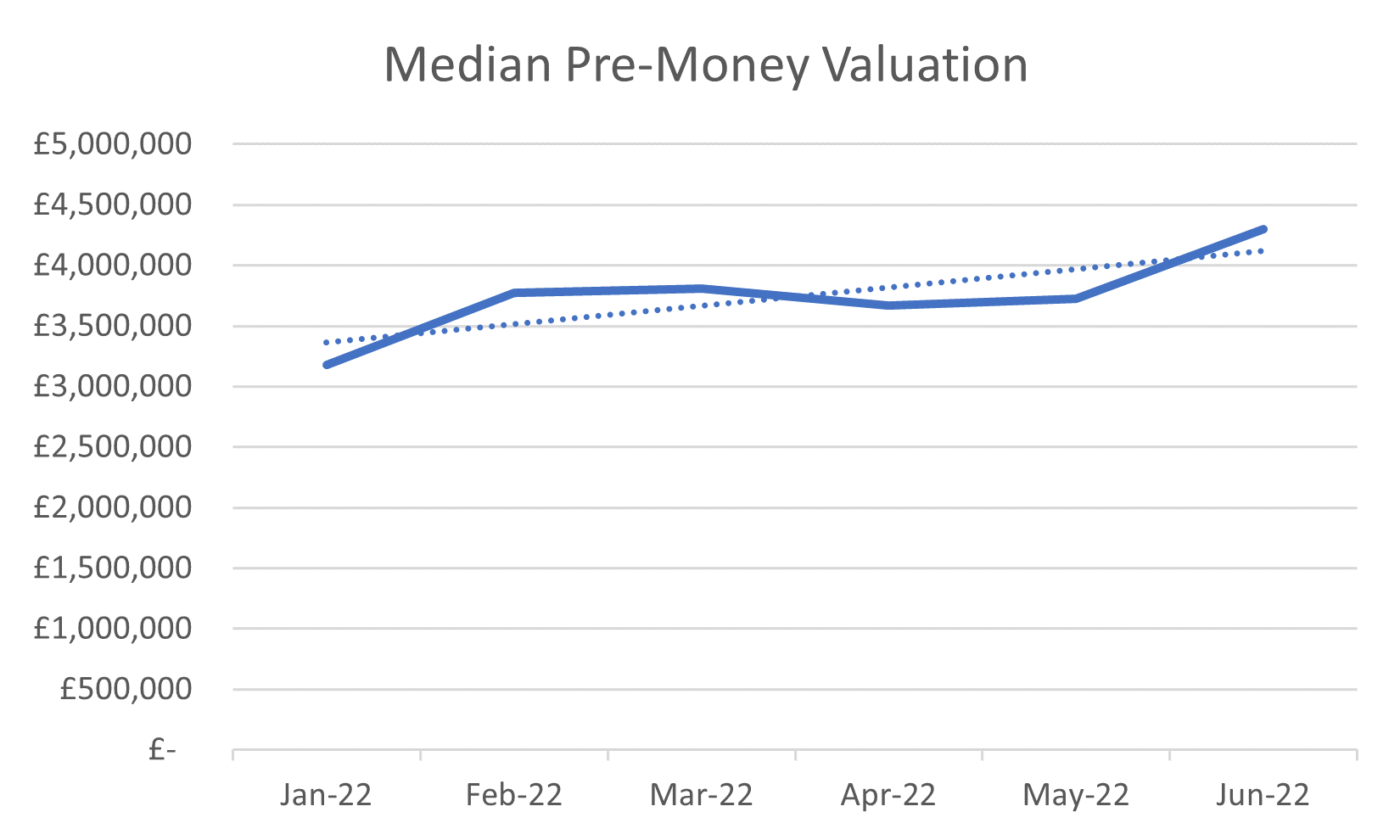

Pre-Seed

At the pre-seed stage, founders may be looking beyond their immediate network to angel syndicates, very early-stage VCs (including SEIS and EIS funds) and deep-pocketed high-net-worth investors. At this stage, some more science may be applied to valuation, but assumptions will remain highly speculative. The startup may be able to demonstrate some proof of concept but any revenues are likely to remain de minimus.

Like the Friends & Family cohort, pre-seed valuations have trended up over the past 6 months. Having said that, pricing in January 2022 was particularly weak (in aggregate), whilst June 2022 was unusually strong.

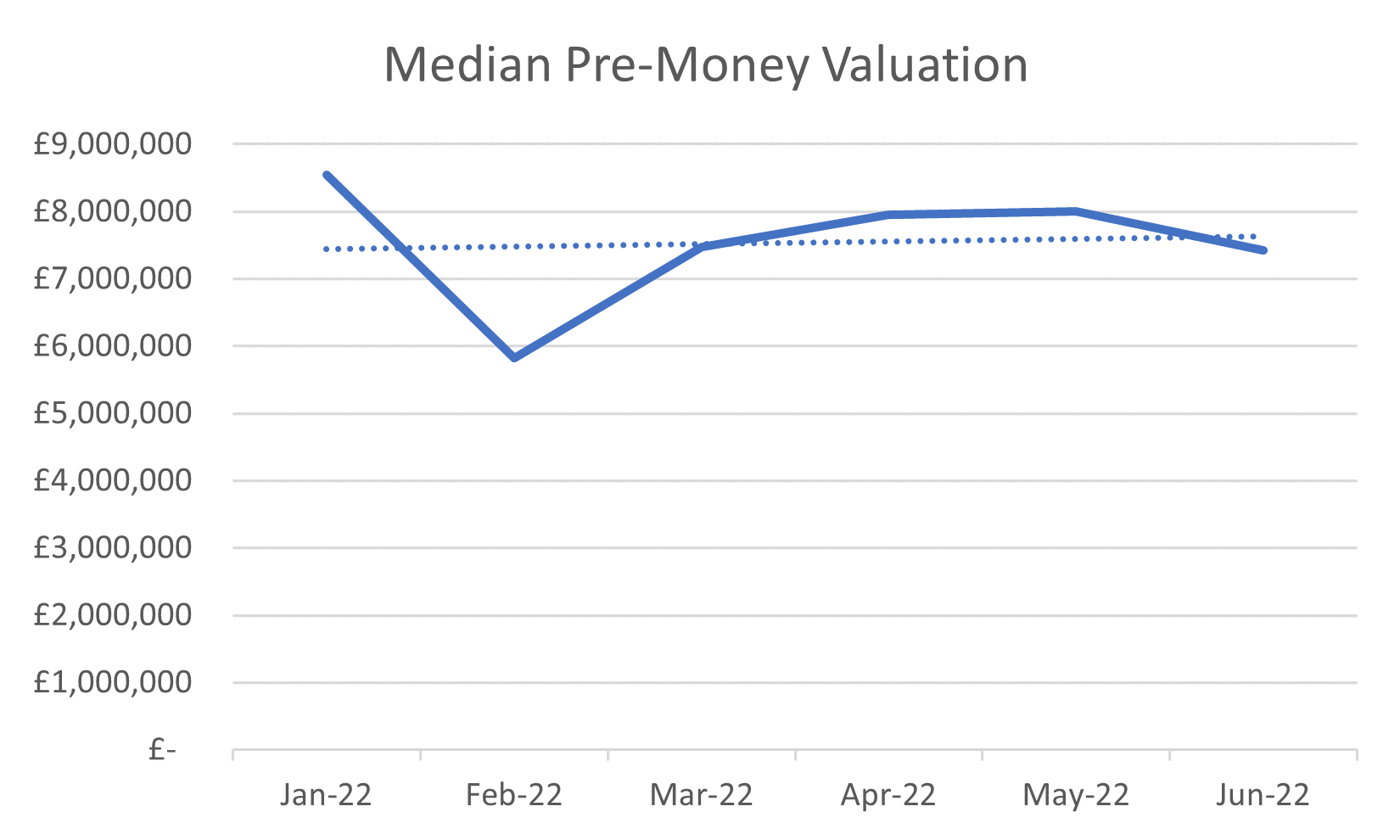

Seed

By the time the Seed stage is reached, a startup may be able to demonstrate more meaningful revenues, although it may still not have discovered the elusive product-market fit. It may still be meaningless to attach a revenue multiple to a business but investors will be working on more robust assumptions (than at pre-seed stage) to determine what the business might be worth one day; an entry valuation can then be derived by working back from this theoretical exit value based on the investor’s required rate of return. The resultant entry valuation can then be corroborated with the market.

Pre-money valuations at the Seed stage have trended sideways during the first half of 2022, albeit there was a sharp ‘sell-off’ in February.

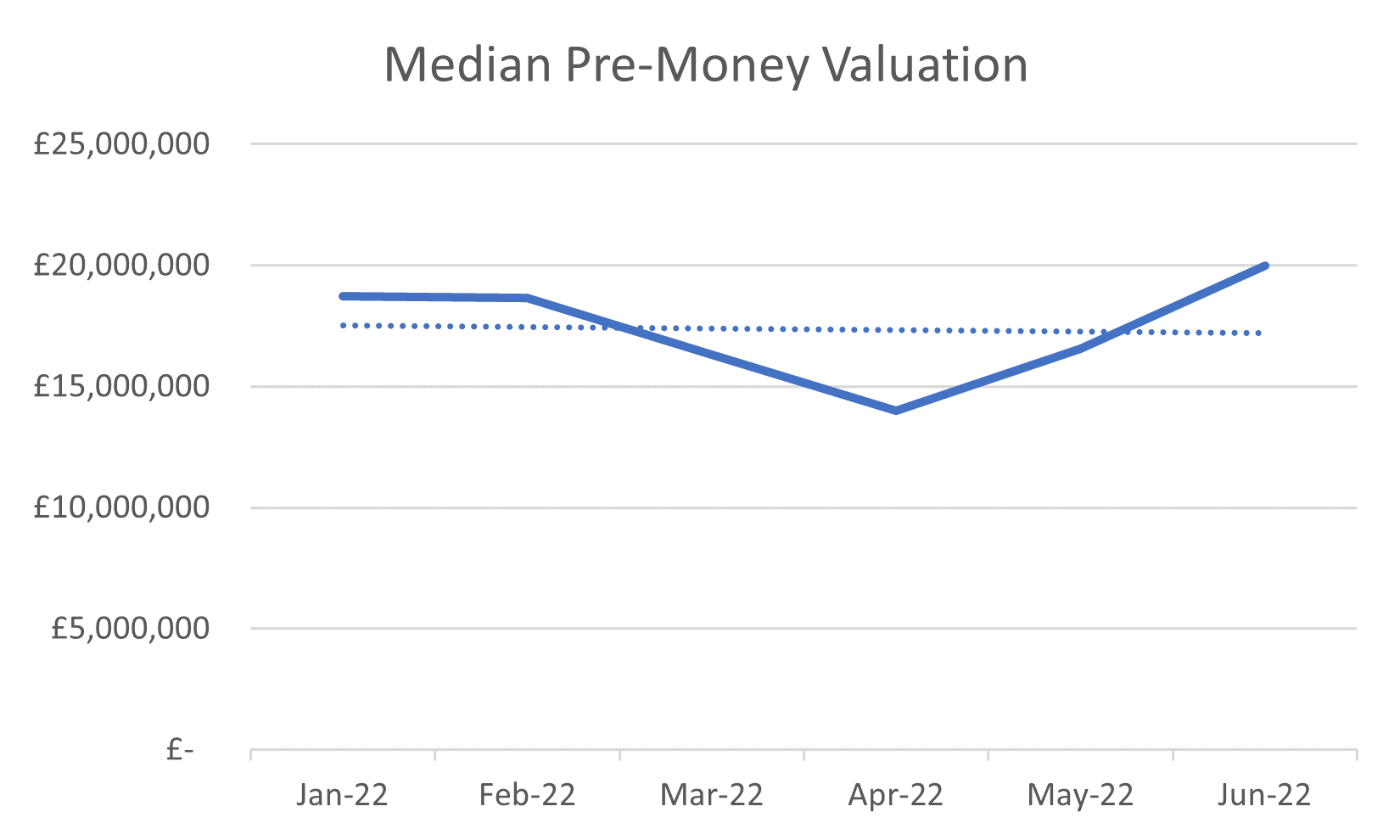

Series A

Companies raising at the Series A stage will probably have demonstrated product market fit and will be able to demonstrate some of the key metrics (especially in SaaS) that investors will use to model outcomes and gauge valuations. A key methodology to price the round may be to take run-rate revenues (or forecast revenues) and attribute a multiple to this figure. If public company revenue multiples are trending lower, it would make sense that this rubs off on private companies. (The absence of revenues at the earlier stages above makes it difficult to take this stance – 10 times zero revenue is the same as 5 times zero revenue!)

It, therefore, makes sense to see Series A pre-money valuations trending lower. However, we note a bounce-back from a low in April 2022.

What is going on?

The analysis demonstrates that there has been little impact on the valuations of rounds up to Seed stage. If anything, these valuations have trended up over the past 6 months as public markets have come crashing down. It provides proof of the lack of correlation between very early-stage tech and big tech valuations. When there are no fundamentals to value a business (revenue and profits), pricing defaults to ‘market’, based on sensible dilution for the capital being invested at that stage. If £1m for 20% of a pre-revenue SaaS startup felt right in January, it probably feels right now.

Furthermore, startups with mature revenue figures will have their valuations scrutinized and benchmarked against their peers If peer group revenue multiples are falling, you must move with the market.

MARKTOMARKET

MarktoMarket collects rich data on every equity fundraising event (announced and unannounced) in the UK. Our easily searchable database allows our advisory and venture capital customers to identify, analyse and price investments. MarktoMarket’s auditable data gives users the confidence that they are dealing with intelligence that can be trusted.

To continue the discussions about how data can support your business, contact Doug Lawson.