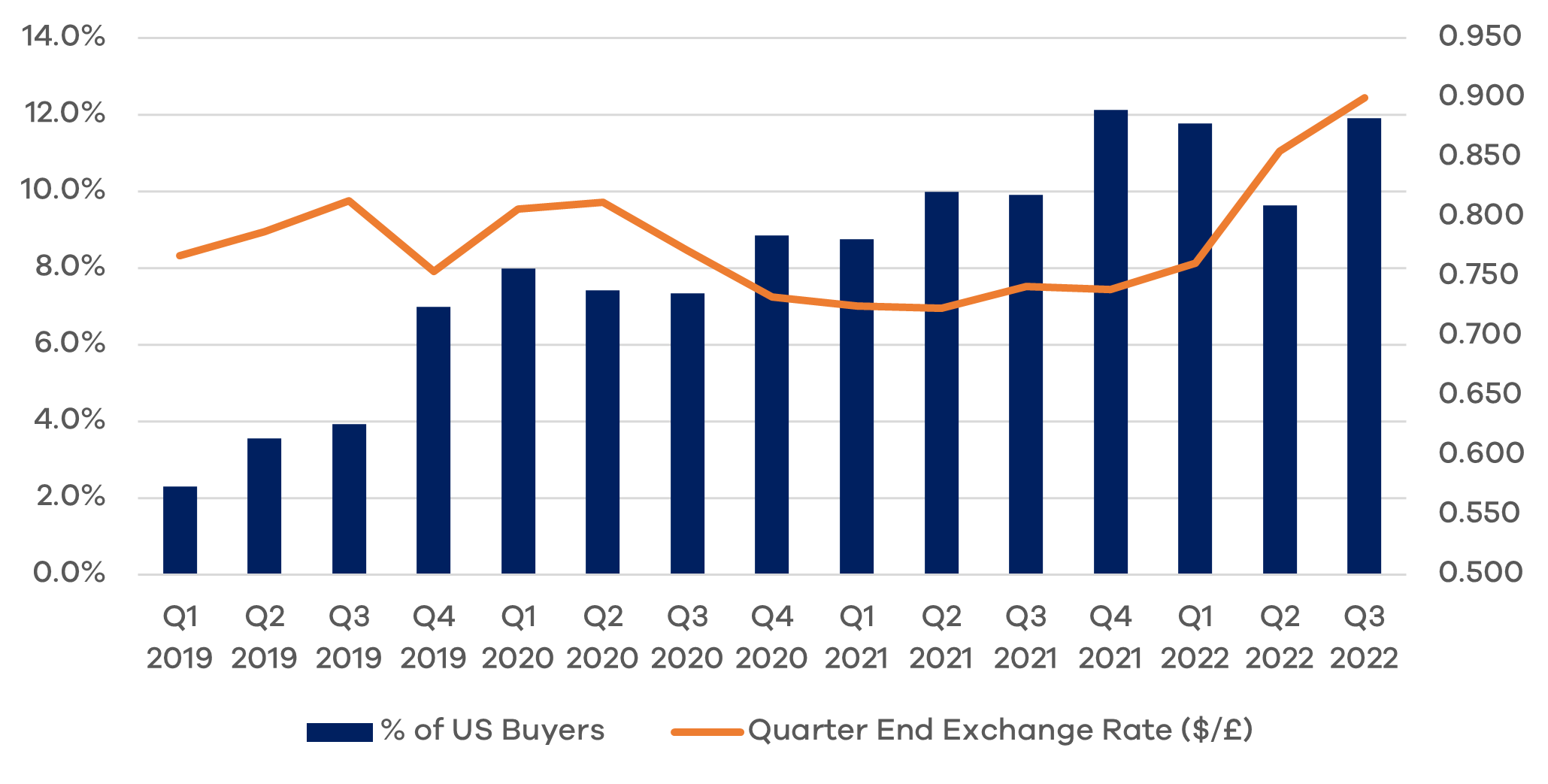

US Acquirers Taking Advantage of Weak Sterling

Here at MarktoMarket we have noticed an interesting, if perhaps unsurprising, trend. Since the previous UK Government’s announcement of unfunded growth plans, Sterling has plummeted against the US Dollar to lows unseen since 1985. Whilst this has driven-up domestic prices of imported goods (including petrol and approximately half of our food), it has created an irresistible opportunity for cash-rich overseas buyers.

Whilst the takeovers of big plcs grab the headlines, the real action is in the small and mid-private markets, where canny US buyers have been quietly going about their business. The proportion of total UK company exits to US buyers has been trending up since Q1 2019. The recent period of Sterling’s weakness is unlikely to dampen enthusiasm from across the pond, albeit Q2 witnessed subdued interest.

Given M&A transaction leads times, it’s wrong to conflate completion activity with the exchange rates at that time. Rather, exchange rate movements are likely to be a leading indicator of future US interest in UK acquisition targets. Current rates and futures pricing suggest that there will be little letup in this trend.

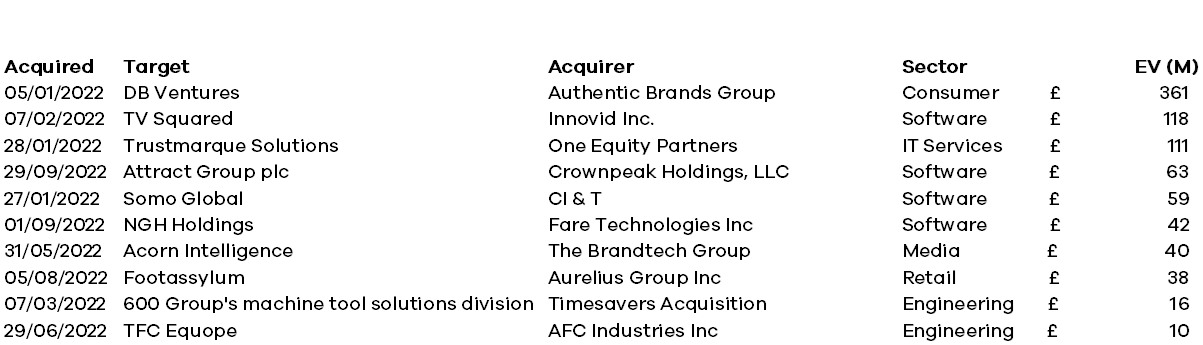

Figure 2: Selection of 2022 UK acquisitions by US buyers

All data has been sourced from MarktoMarket’s Data platform.

MARKTOMARKET

MarktoMarket collects rich data on private businesses, particularly in the small and mid-market. Our easily searchable database allows our advisory, private equity and corporate customers to identify, analyse and price investments. MarktoMarket’s auditable data gives users the confidence that they are dealing with intelligence that can be trusted.

To continue the discussions about how data can support your business, contact Olga Melnyk.