UK M&A 2021 Indices

report Highlights

Highlights from our 2021 UK M&A Valuation Indices, covering UK M&A transaction multiples for M&A deals completed in 2020.

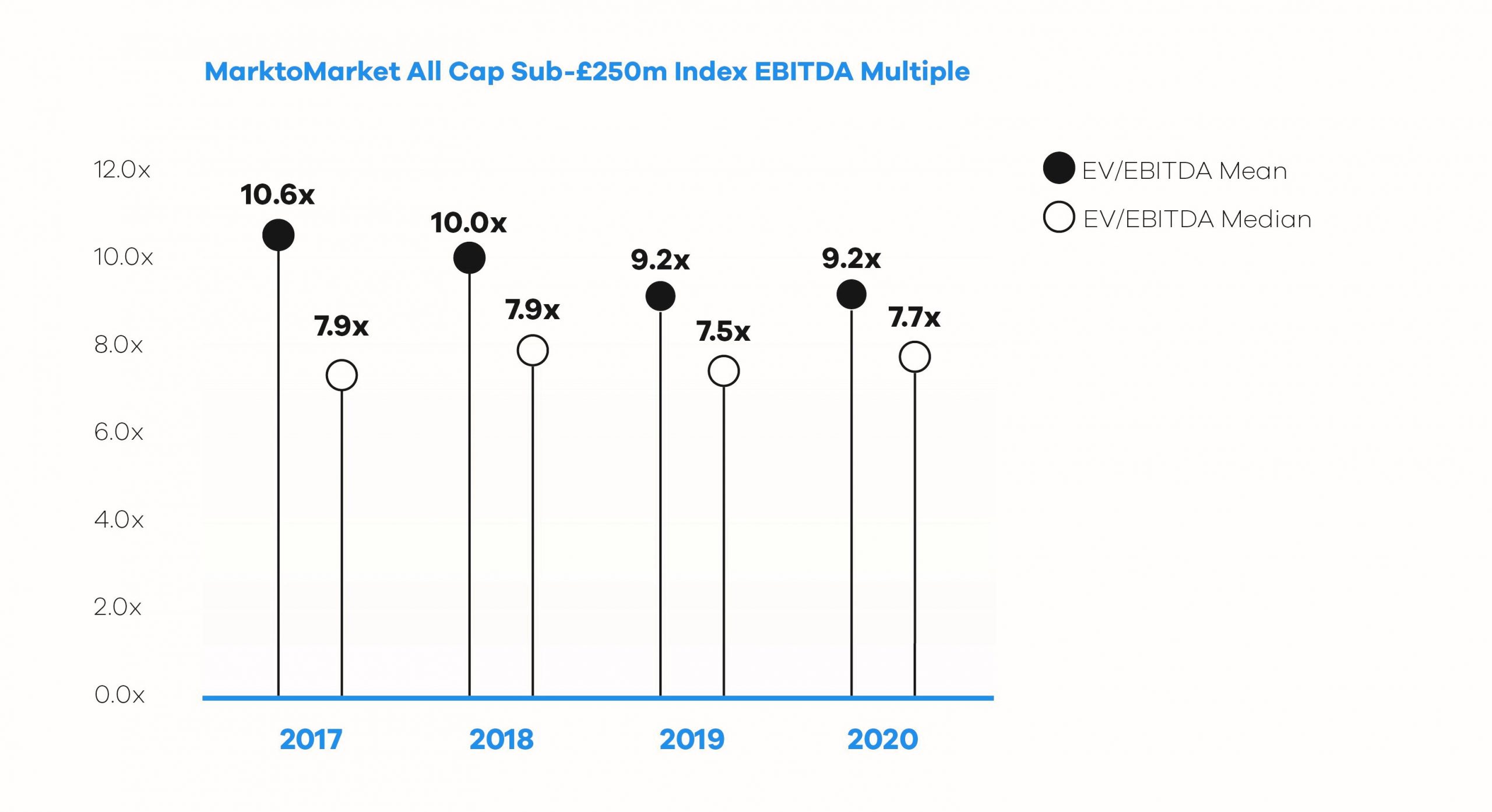

Despite the economic upheaval created by COVID-19, M&A multiples held up well when viewed over the course of calendar year 2020.

The MarktoMarket All Cap Index, representing the mean Enterprise Value to EBITDA (EV/EBITDA) multiple paid in UK M&A deals in 2020, excluding outliers, was 9.2x. The 2019 comparison was also 9.2x.

The mean deal size in our sample increased from £21 million in 2019 to £33 million in 2020 (the median grew from £6.2 million to £8.5 million).

Please note that the chart does not imply that deal values have increased during 2020 relative to 2019 but rather that the deal sizes have increased within our datasets, which consist of MarktoMarket’s proprietary data and intelligence submitted by our network.

SIZE BASED INDICES

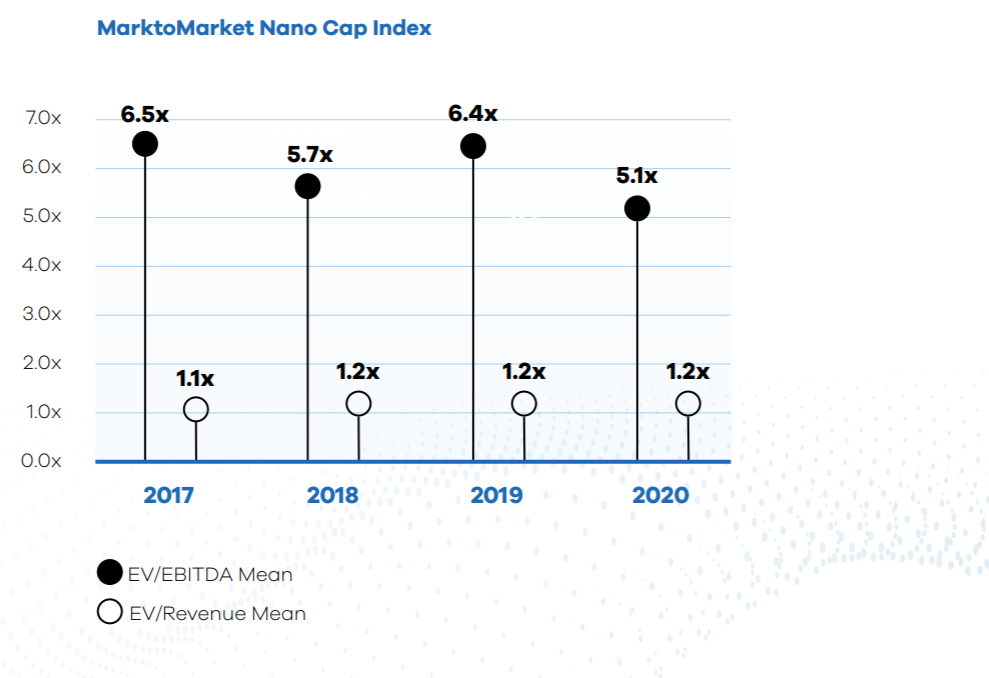

The Nano-Cap index, which consists of M&A transactions valued at under £2.5m, is designed to be representative of the smallest companies in the UK. Due to the limited disclosure requirements imposed upon the UK’s smallest private companies, information is sparse. However, MarktoMarket’s technology and in-house research team, alongside contributions from our customers, allow us to create an index for these companies.

Our data suggests that there was a significant contraction of EBITDA multiples in sales of businesses valued at under £2.5 million. This contraction was also evident in the MarktoMarket Micro Cap Index (deal sizes £2.5 – 10 million), whilst the MarktoMarket Small Cap Index (deal sizes £10 – 50 million) posted gains.

SECTOR BASED INDICES

Within sectors, the MarktoMarket Technology, Media & Telecommunications (“TMT”) Index was strong in 2020 relative to 2019, whilst the MarktoMarket Consumer Index fell heavily. This outcome was to be expected, given that technology companies were amongst the biggest ‘winners’ from the shut-down precipitated by the pandemic, whilst consumer-facing businesses suffered existential threats.

The MarktoMarket Industrial and Business Support Services (I&BSS) and Financial Services indices also gained, albeit less materially than the TMT index.

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full version of the MarktoMarket Valuation Indices.

For the full list of previous reports visit our reports page.

Request the Report

Submit the form for the executive report.