MarktoMarket Roundtable: Trends in investment activity in the North West and predictions for 2024

MarktoMarket recently hosted a roundtable at the Midland Hotel in Manchester with a number of investment banks, accountancy firms and boutiques in the North West to reflect on deal activity and valuations in 2023, and discuss opportunities in the region for 2024 and beyond.

Deal activity

We began the session by presenting data sourced from MarktoMarket, looking at UK-wide M&A activity.

As we near the end of the year, the attendees were able to reflect on deal activity over the last 12 months. The consensus was that the year-on-year drop in deal activity is due to a more cautious approach from buyers. The money is still there but it is more expensive. This, coupled with less competitive tension, means that deal cycles are taking longer and due diligence processes are often extended.

Valuations

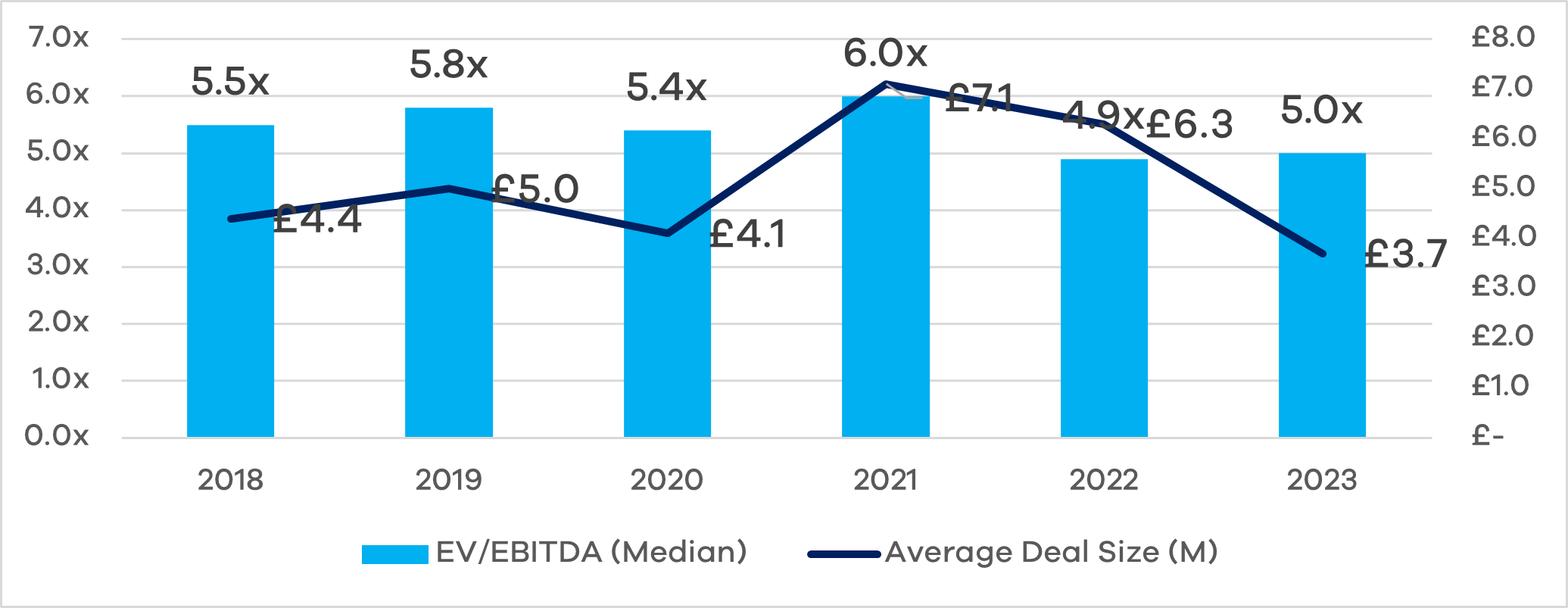

Looking at valuation metrics across the UK over the last 5 years, a decline in valuation multiples has coincided with the rise in interest rates, introducing falling deal values in 2022 and a continuation of this in 2023.

Despite abnormally high deal values in 2021, many vendors expected these levels to continue.. The view from the attendees was that, as long as interest rates remain high, deal values are unlikely to return to 2021 levels and advisers are stressing this to vendors when pitching for sale mandates in order to manage expectations.

The importance of the North West

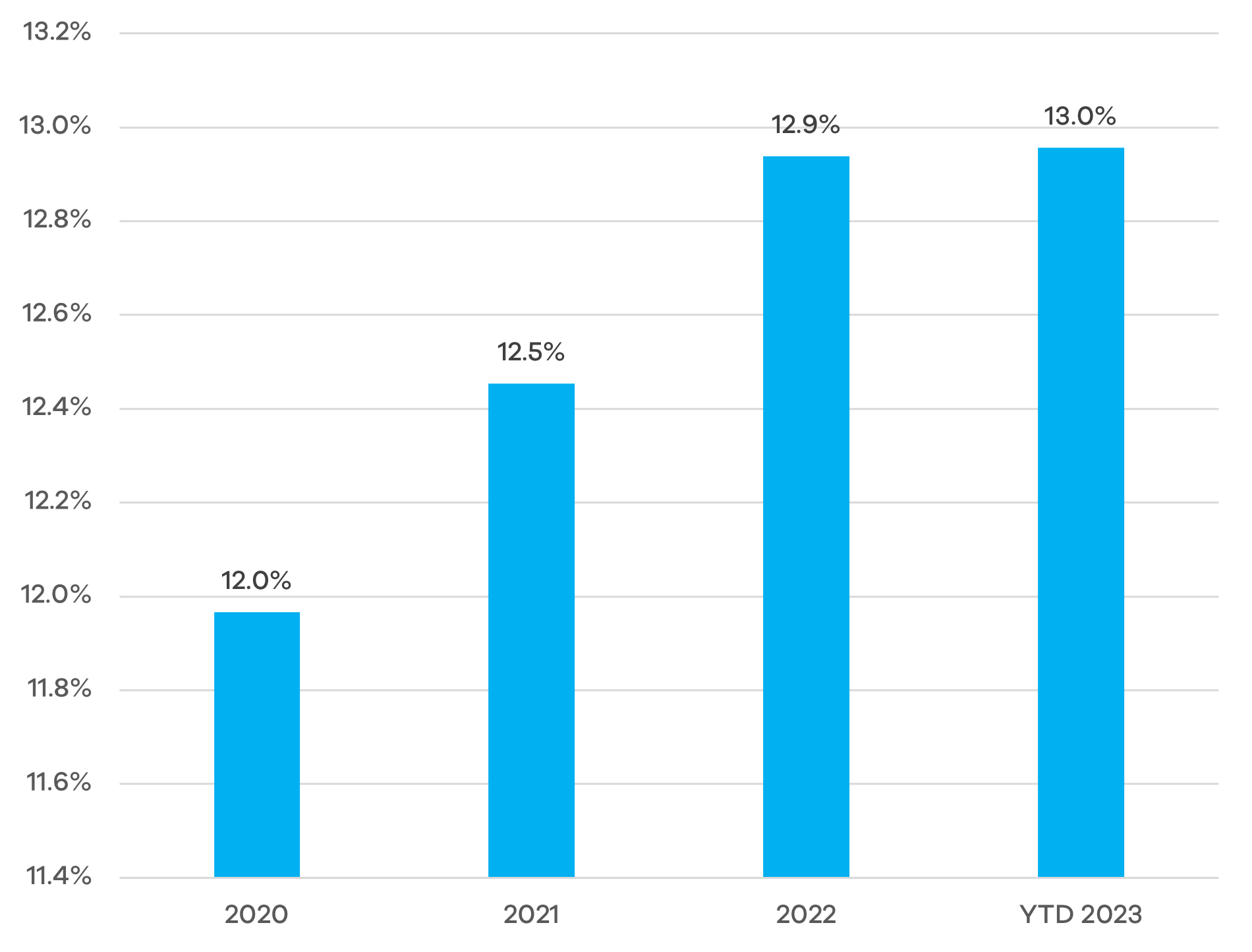

Our attendees consisted of international, UK-wide and local boutique firms who all echoed one another in their belief of the importance of the North West in the UK economy. The funding gap in the regions outside of London has always been very well documented but, rather promisingly, deals in the North West are taking an increase of market share year-on-year.

Whilst this funding gap remains, investors in the region are well positioned to deploy capital. There are very good businesses in the North West that are looking for northern based money and the result of fewer institutions in the region means that there is less of bidding frenzy and less competitive tension. Historically, funds that have that seen success in the North West have remained in the region when the economic environment has been less favourable. There is a view that you have to be seen to be “on the ground” when times are tough, as well as when times are good.

Despite the increase in investors in the North West, advisers in the area would still look nationally to source capital. That is not to say that there is not enough capital in the North West but looking wider for funding is important to ensure the best price, especially if there a niche sector focus. Where the business is more generic, it may suffice to focus capital raising activities in the North West alone.

MARKTOMARKET

MarktoMarket collects rich data on private businesses, particularly in the small and mid-market. Our easily searchable database allows our advisory, private equity and corporate customers to identify, analyse and price investments and monitor market trends to create their own content.

MarktoMarket’s auditable data gives users the confidence that they are dealing with intelligence that can be trusted.

To continue the discussions about how data can support your business, contact Olga Melnyk at olga@marktomarket.io.