The Alternative Premier League

LIVERPOOL v MANCHESTER UNITED

The last few years have witnessed unprecedented acquisition interest in English football clubs. The latest names to be associated with a sale are North West rivals Liverpool FC and Manchester United. Forbes estimates Liverpool’s value at £3.6 billion. Achieving a price anywhere near this would represent an enormous profit for John W Henry’s Fenway Sports, which acquired the club for around £300 million in 2010. Manchester United, listed on the New York Stock Exchange, has a market capitalisation of $3.8 billion. With an additional $0.5 billion of net debt, the enterprise value is $4.3 billion, in-line with the Liverpool estimate.

CHELSEA

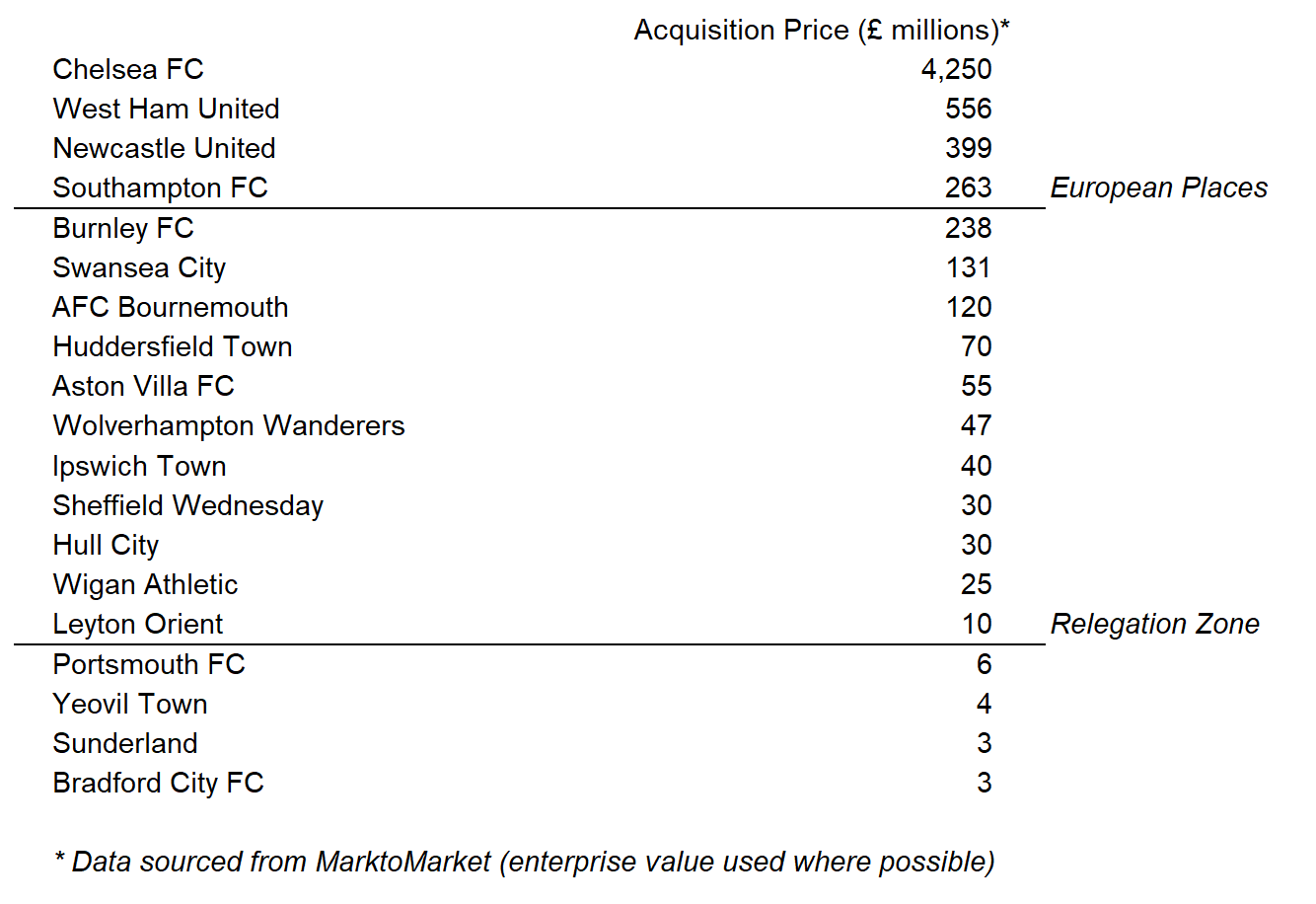

These are big numbers but still short of the £4.3 billion Todd Boehly and Clearlake Capital paid to take Chelsea FC off Roman Abramovich’s hands last year. The price represented nearly 10x the club’s revenue. On the same basis, Manchester United and Liverpool would be worth £6 billion and £5 billion respectively.

EUROPA LEAGUE SPOTS

More modest sums changed hands when Newcastle United was sold to Saudi Arabia’s Public Investment Fund. The £305 million paid for the Geordies was less than the £555 million valuation at which Czech businessman Daniel Kretinsky acquired a 27% stake in West Ham United. Prior to this Burnley FC was acquired by US-based ALK Capital for £238 million. Just before Christmas, AFC Bournemouth was snapped up for £120 million by a consortium led by Las Vegas-based businessman Bill Foley.

RELEGATION ZONE

Propping-up the table are the once-mighty Ipswich Town, acquired by ORG, another American investment fund, and Hull City, which was acquired by Turkish businessman Acun Ilicali for £30 million.

SOCCER

With a few exceptions, it is US buyers who are the protagonists in this world. They see the opportunity to export US practices in monitising sport and can buy into all but the biggest English clubs for a fraction of the price of a US soccer franchise.

Who will be next?

MARKTOMARKET

MarktoMarket collects rich data on private businesses, particularly in the small and mid-market. Our easily searchable database allows our advisory, private equity and corporate customers to identify, analyse and price investments.

MarktoMarket’s auditable data gives users the confidence that they are dealing with intelligence that can be trusted

To continue the discussions about how data can support your business, contact Olga Melnyk at olga@marktomarket.io.