Professional Services M&A still slowing

Amid news of capital flowing into professional services firms to fund buy and build strategies, we look at how this acquisition firepower has been deployed over the past five years and current trends.

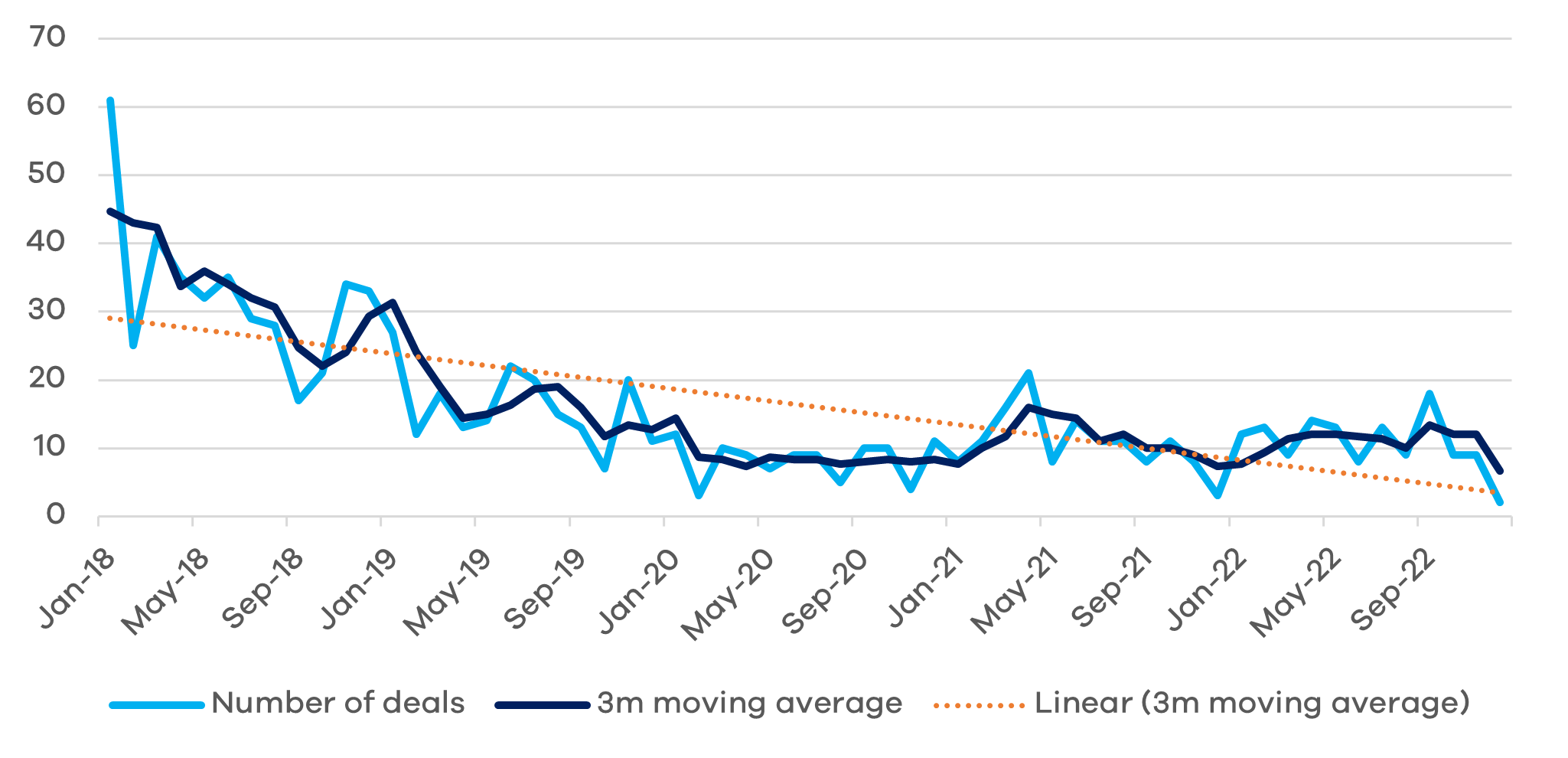

Wealth and Financial Planning

The private client advisory market, encompassing wealth managers and independent financial advisers/planners, has seen a big drop-off in consolidation activity since the heady days of 2018. As Figure 1 illustrates, the decline started well before the global collapse in M&A in Q2 2020. The 3-month moving average in deal completions had already fallen from 45 in January 2018 to 9 by February 2020. As markets recovered, Wealth and Financial Planning M&A saw some resurgence but volumes remain subdued. Our customers tell us the market remains fragmented and there is plenty more to go for but the data suggests that the low-hanging fruit has been picked.

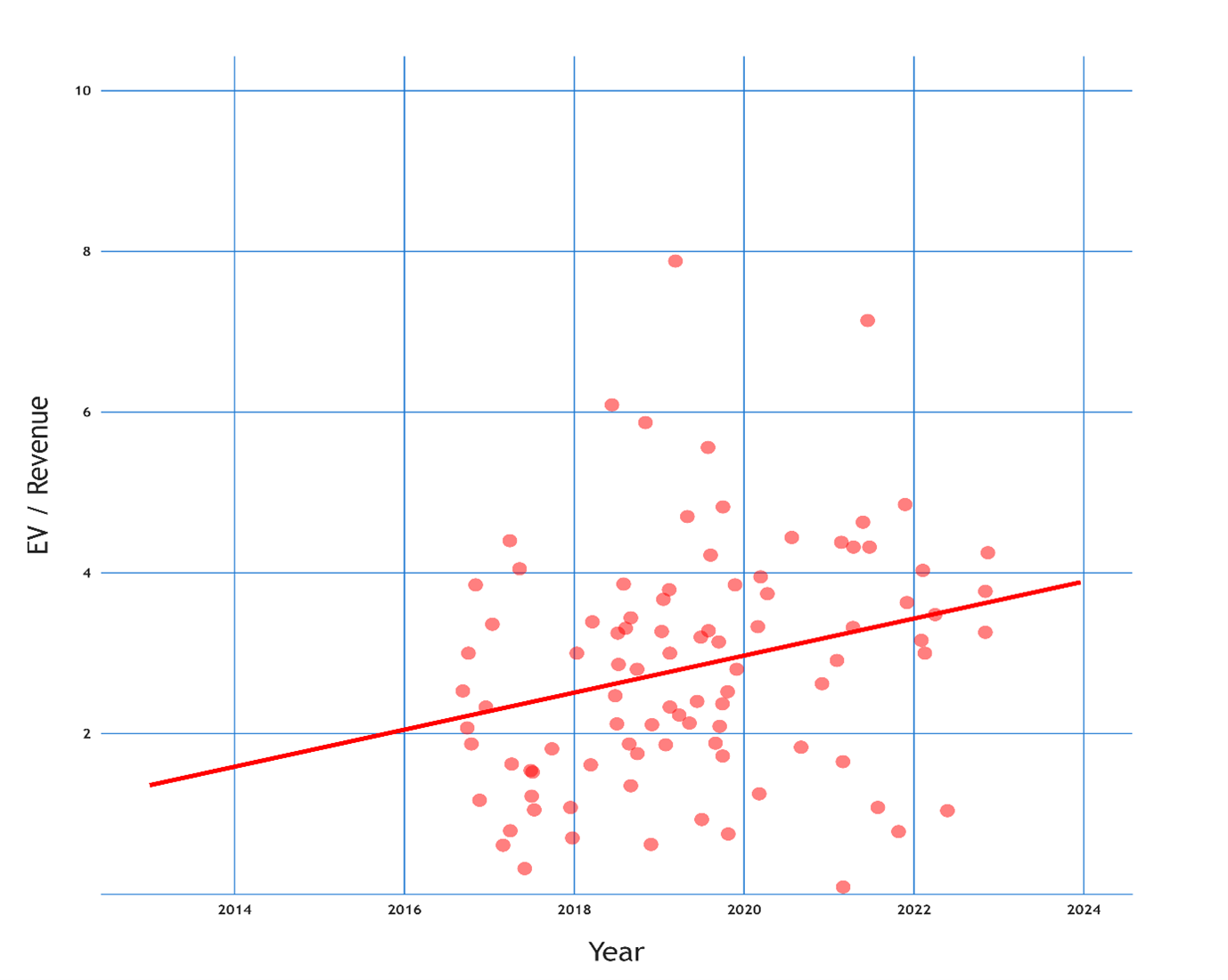

Over the period under review, valuations have trended up, as indicated by Figure 2. Measured as a multiple of current year (run-rate) revenues, businesses in the sector are changing hands at a median multiple of around 3x, with plenty of deals transacting above 4x fees. This reflects the high-quality, recurring nature of revenues in the industry.

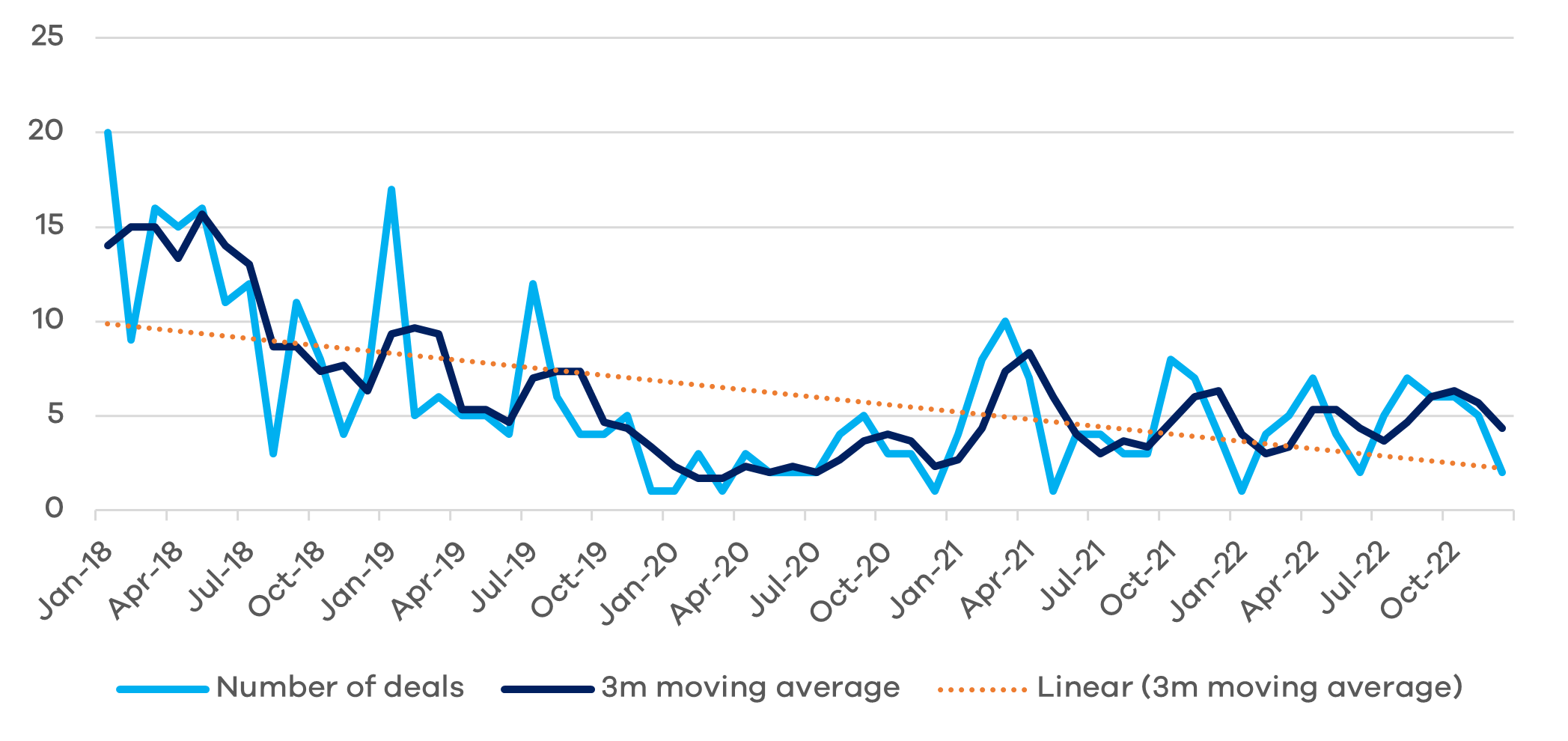

Accountancy

Whilst consolidation in the Wealth and Financial Planning sector was seen as a precursor to buy and build strategies in the accounting world, M&A between firms of accountants has followed a similar trend. Deal volumes have dropped since 2018 despite the emergence of more acquisition vehicles. The 3 months rolling average shows little pick-up over the past 2 years.

Multiples in Accountancy tend to be lower than in the Wealth and Financial Planning sector, with less “sticky” revenues cited as a key reason. Specialist operations may attract higher pricing but more traditional practices are often valued below 1x billings. Azets (backed by Hg Capital) and Xeinadin (based by Exponent) are the most active buyers over the period and, therefore, the price setters in the industry.

MARKTOMARKET

MarktoMarket collects rich data on private businesses, particularly in the small and mid-market. Our easily searchable database allows our advisory, private equity and corporate customers to identify, analyse and price investments.

MarktoMarket’s auditable data gives users the confidence that they are dealing with intelligence that can be trusted

To continue the discussions about how data can support your business, contact Olga Melnyk at olga@marktomarket.io.