M&A in the Accounting Sector

Accountants are accustomed to being involved in M&A deals in an advisory capacity. More recently, these professional services firms have found themselves in the crosshairs. Private equity has flooded into the sector and fuelled a boom in acquisitions and mergers of small and mid-sized accountants.

We have pulled together data from MarktoMarket to show the trends, key players and valuations of the firms participating in this phenomenon.

Changing Landscapes: is the Partnership model broken?

Partnerships, once the default model for accounting firms, have become less common, with many accountants looking at alternative models.

MarktoMarket CEO Doug Lawson, William Skinner, Partner at Phoenix Equity Partner, Roy Farmer, Corporate Finance Partner with Dains Accountants, and Paul Mann, Corporate Partner at Squire Patton Boggs, discussed, in a recent webinar, the changing landscapes of the accounting and legal sectors, and whether the partnership model is now broken.

The panel felt that mindset changes and a generational shift have led to fewer partnerships being created. Younger leaders are either less willing to take on the burden of running a business, or not capable of raising the capital. Furthermore, smaller partnerships may lack the resources to invest in key elements of business, namely technology, people development and marketing. Increased regulation has put pressure on margins.

Smaller firms now see consolidation with a larger company as an opportunity to realise a capital gain, as well as a succession option.

Data taken from Float shows how the number of small partnership accountancy firms has nearly halved as they have been amalgamated into large and mid-sized companies.

To listen to the full recording of our webinar with Paul, Roy and William, ‘M&A in the Legal and Accounting Professions’, get in touch here.

Trends

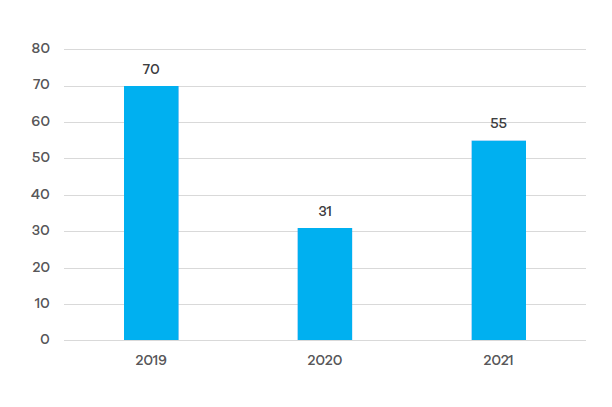

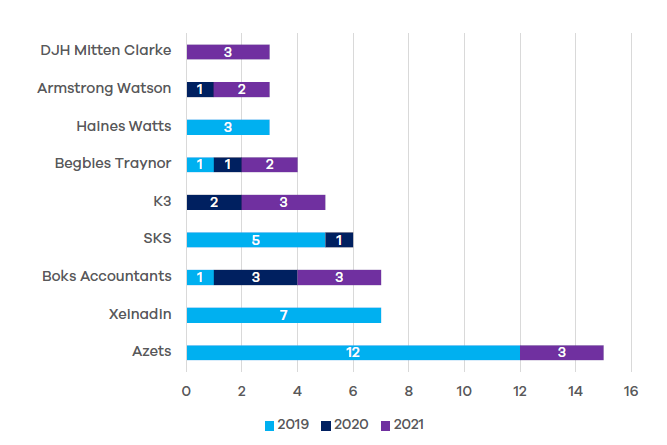

Deal volumes within the accountancy sector have been inconsistent through the last three years. The COVID-19 pandemic interrupted a consistent growth trend. From the beginning of the easing of lockdown restrictions, M&A deals have started to return to pre-pandemic levels. Azets Group has been the most aggressive, acquiring 16 companies in 3 years. In 2021, K3 Capital, Boks Accountants and DJH Mitten Clarke matched Azets group’s 3 acquisitions.

From the profile of acquisition activity, especially among smaller local and regional companies, we can see drives towards consolidation led by firms seeking to broaden their geographic coverage and service offering, whilst benefiting from the overhead savings that flow from the centralisation of administrative costs.

Buyers

At the top of the table, Azets has made over double the acquisitions of its nearest competitor across the last three years. With HgCapital providing private equity backing, Azets are in a position to maintain their place at the top of the buyer’s league table.

In second place, Xeinadin acquired seven new firms in 2019, but have since been quiet on the M&A front. More recently, they received backing from Exponent Private Equity to fund further M&A opportunities from Q1 2022 and beyond.

In 2021, Boks, K3 and DJH Mitten Clarke joined Azets as active acquirers in the space.

Valuations

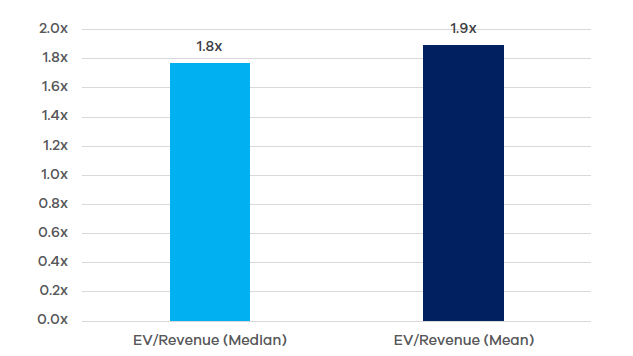

By focusing on multiples of billings when looking at valuations, rather than profits, the data recognises that many of the acquired businesses were partnerships, where surpluses are typically removed via drawings.

The billing multiples taken include any deferred consideration payments. Therefore, the upfront multiples paid may have been materially lower than the average.

The multiples are higher than may have been expected, highlighting the attraction of repeatable audit and accounting revenues, as well as the increasing competition for these assets as new buyers, backed by private equity, have entered the market. Our averages include specialist firms, the nature of which may serve to inflate multiples.

The median multiple over the three years in focus was 1.8x and the mean multiple was 1.9x. These include any deferred and/or contingent considerations.

Looking Forwards

Looking into 2022, both Azets and K3, the business broking and corporate finance group, have already kick-started their M&A activities, acquiring Inspire and Insight Marketing respectively (the latter deal highlighting a willingness to bolt-on ancillary, non-financial service lines). Azets and K3 are continuing their growth strategies thanks to strong capitalisation.

The trend of consolidation looks to continue. More firms are accepting funding from private equity firms for buy and build strategies. This includes Dains/Horizon, A²+B/August, Azets/Hg, Xeinadin/Exponent and Jeffreys Henry/Tenzing. These deals suggest a belief that growth through consolidation will be the big theme in the accounting industry. For a while at least.

MarktoMarket

MarktoMarket is a data platform and marketplace for the private capital markets.

For more details contact nick.webb@marktomarket.io