How much is a Corporate Finance firm worth?

spectrum

FRP Advisory has announced its acquisition of Spectrum, a corporate finance advisory business working from offices in Reading, Southampton and London. The acquisition price of £9.4 million (plus up to £3m for net assets at completion) demonstrates that there is substantial goodwill in independent advisory firms with solid track records. Due to the slowdown in deal-making in its last financial year (to Sept ’20), Spectrum’s revenues fell from a recent average of £6.4 million in the prior two periods to £4.0 million. At pre-2020 fee levels, margins were handsome, with adjusted EBITDA of £2.1 million.

Sucking eggs

At the risk of telling a large proportion of our customer base what they already know, margins can vary significantly between boutiques. The cost base is dominated by staff remuneration and this is likely to vary in-line with fees, which tend to be volatile and dependant upon business confidence and, therefore, appetite for M&A. In good years, fee income may be largely distributed as remuneration, with modest sums retained and re-invested. Whilst some firms will hold back capital for ‘rainy days’, in poorer years belts tend to be tightened and remuneration is adjusted downwards rather than topped-up from reserves – in other words, you eat what you kill. As such, it is difficult to determine normalised margins and we believe that buyers of corporate finance businesses will focus on revenues, rather than profits, and decide whether a cost base can be structured around these revenues which can keep staff incentivised as well as provide an adequate return on investment for the buyer.

When assessing revenue, the buyer will look back at a number of years. The feast or famine nature of the industry means that fee income can be volatile from one year to another, depending on the success rate of deal completions.

Valuations

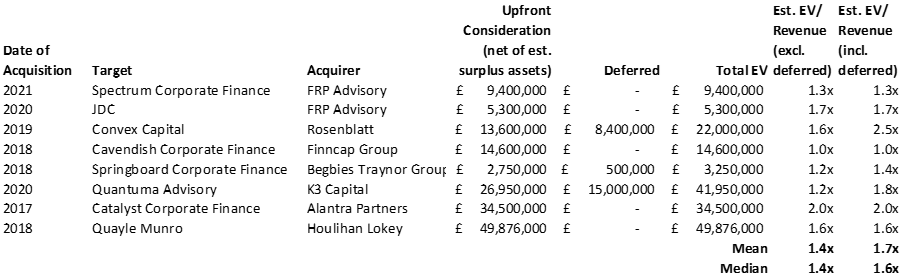

Net of its surplus assets, Spectrum was acquired for 1.3x its estimated forward revenue. Under the anticipated new cost base, the forecast EBITDA multiple translates to 4.5x. How does this compare to other boutiques that have been acquired recently?

We looked at a number of recent transactions in the space and found the Spectrum multiple to be largely in-line with the market.

Corporate Finance M&A Sample

Note: Estimated EV includes deferred consideration.

FRP’s other recent deal – the acquisition of JDC – was completed in 2020 for £5.3 million. This represented 1.7x trailing revenue for the corporate finance and forensics specialist. The historic EBITDA multiple was similar to Spectrum, at 4.4x.

Besides FRP, other buyers of M&A advisory specialists include Houlihan Lokey. Houlihan acquired McQueen in 2015 and Quayle Munro in 2018. Quayle Munro was valued at £60 million but we adjust this to £50 million to reflect estimated surplus assets of £10 million. This would put the business on a revenue multiple of 1.6x. The same multiple was paid by corporate lawyers Rosenblatt for Convex Capital, a Manchester-based advisory house, in 2019. However, add contingent earn-out payments to the Convex vendors and this multiple rises to 2.5x.

Quantuma, a corporate finance, forensics and recovery specialist, was acquired in 2020 by business broker and adviser K3 Capital. K3 paid £30 million upfront and will pay a further £15 million if post-deal targets are achieved. Excluding contingent consideration, the revenue multiple was 1.2x; this rises to 1.8x when future payments are included.

Other recent exits include Cavendish, which combined with small cap broker Finncap to create a full-service investment bank focused on small and mid cap private and public companies. The deal valued Cavendish at £14.6 million, approximately 1x trailing revenues. A year earlier Catalyst Corporate Finance joined Alantra, the Spanish financial services group, for £34.5 million, representing 2x revenue.

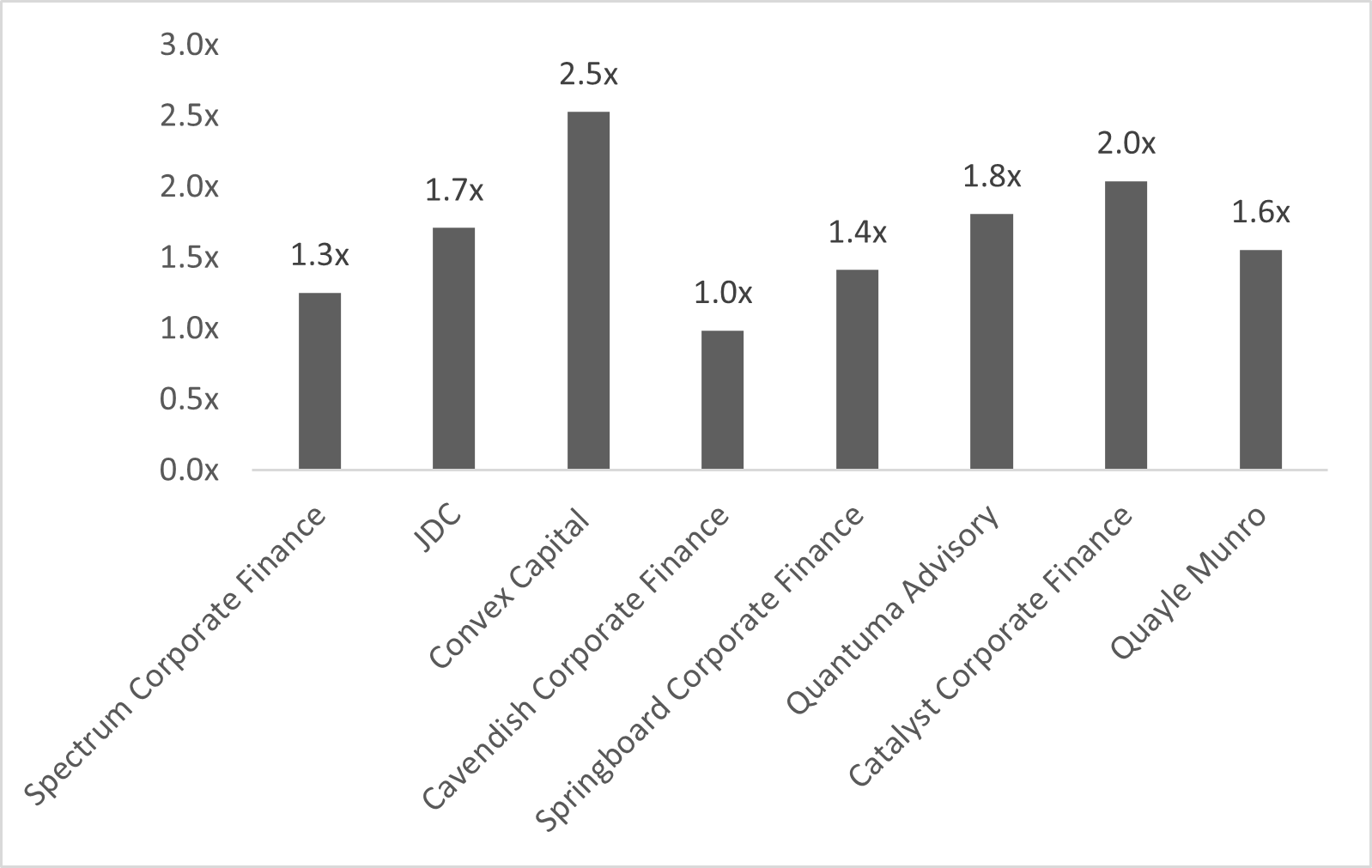

Estimated EV / Revenue Multiples

Source: MarktoMarket data

One common feature of the deals in our analysis is a strong brand name. As well as sector, deal focus and geographic fit, buyers will be looking for sustainable business models that can transcend one or two key individuals and endure beyond their working lives. After all, in the absence of long-term retained revenues, it is this brand and reputation and ensures continuity of fee income from one year to the next.

For further information or to speak to MarktoMarket please contact olga@marktomarket.io.

Transaction data collected by MarktoMarket is gathered and enriched over time and often relies on estimates. As such, data should be treated on a ‘best estimate basis’ and should not be relied upon. Users of this data assume full responsibility for any references to the data and MarktoMarket has no liability for any damage caused by errors or omissions in any information.

Looking for more M&A deal data or new clients to contact?

Book a free platform tour and see how MarktoMarket helps M&A advisers deliver excellent service to their clients and find new deals