Buy Now, Pay Later – Deferred and Performance-Based Consideration

Buying on ‘tick’ is all the rage. Fintechs Klarna and ClearPay have added a sheen of legitimacy to BNPL (Buy Now Pay Later) in the same way that Tinder has validated dating apps.

In corporate finance, structuring a deal to push some of the consideration further into the future is standard practice. A deferred element can help the buyer by using future cashflows generated by the acquired business to finance part of the deal; a contingent component de-risks a transaction by pegging the consideration to the future performance of the target – if the company does not perform in-line with the vendors forecasts, the price is adjusted.

MarktoMarket analysed transaction activity in 2020 with MHA Tait Walker to identify the prevalence of future payments (deferred and contingent) in UK M&A deals.

DO ALL DEALS BUILD-IN DEFERRED CONSIDERATION?

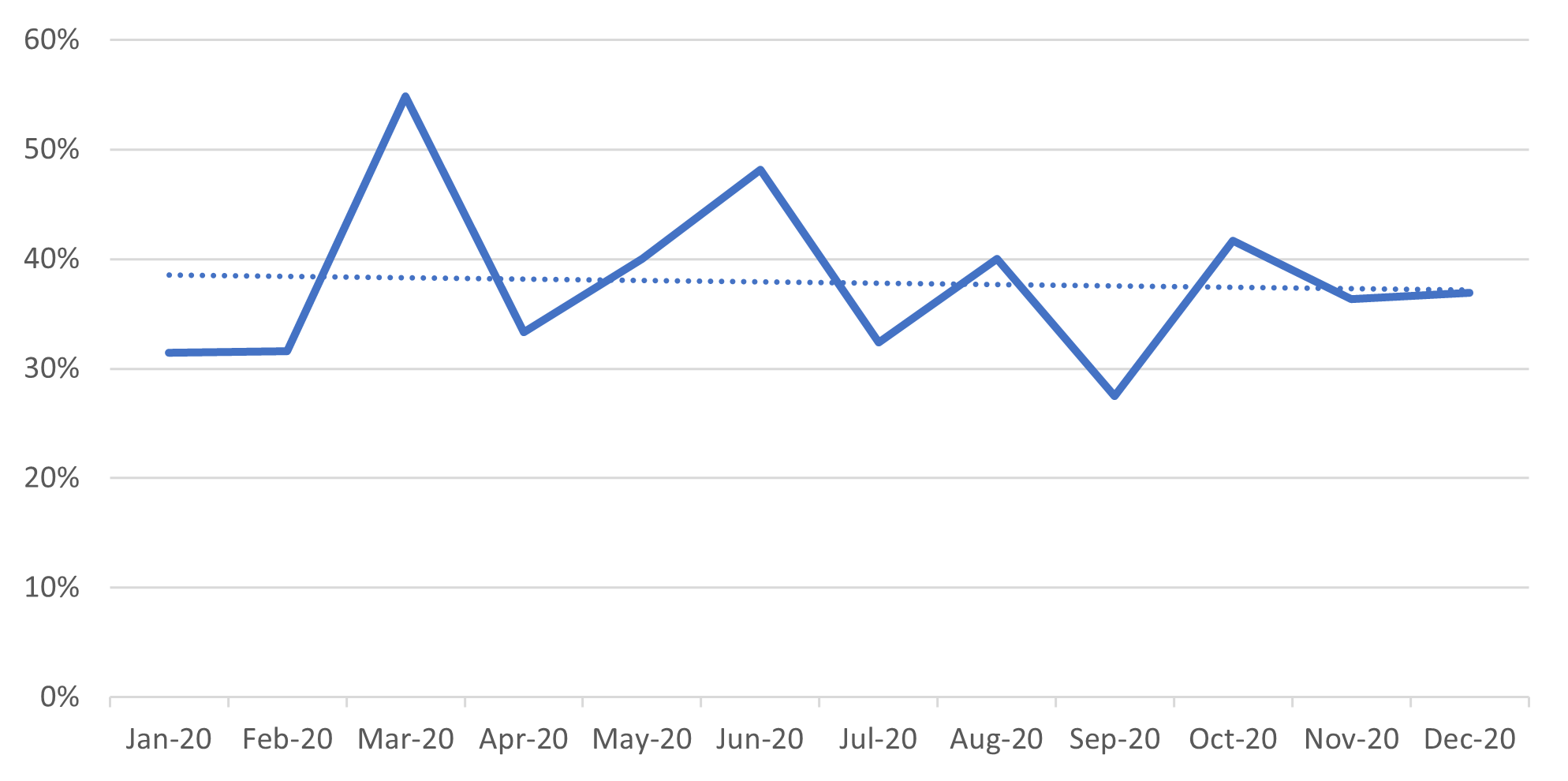

A sample of 450 deals was reviewed. Within this sample, 38% of deals were structured to include an element of future consideration. There was a spike in deals comprising a future payment in March 2020 – whilst March was a busy month for deal completions, we might surmise that the increase in deferred and contingent considerations reflected the perceived risk in completing a transaction during the early stages of the pandemic. Deal volumes slowed considerably in April but the proportion of deals with future payments built-in fell and trended between 28% and 48% for the remaining months. A possible explanation is the shift in deal-making towards ‘COVID-proof’ industries where competition for assets was high and, perhaps, push-back on deferred and contingent payments was more acute amongst vendors and their advisers.

Chart 1: UK M&A 2020 – % of deals with an element of deferred and/or contingent consideration

HOW MUCH CONSIDERATION CAN BE PUSHED INTO THE FUTURE?

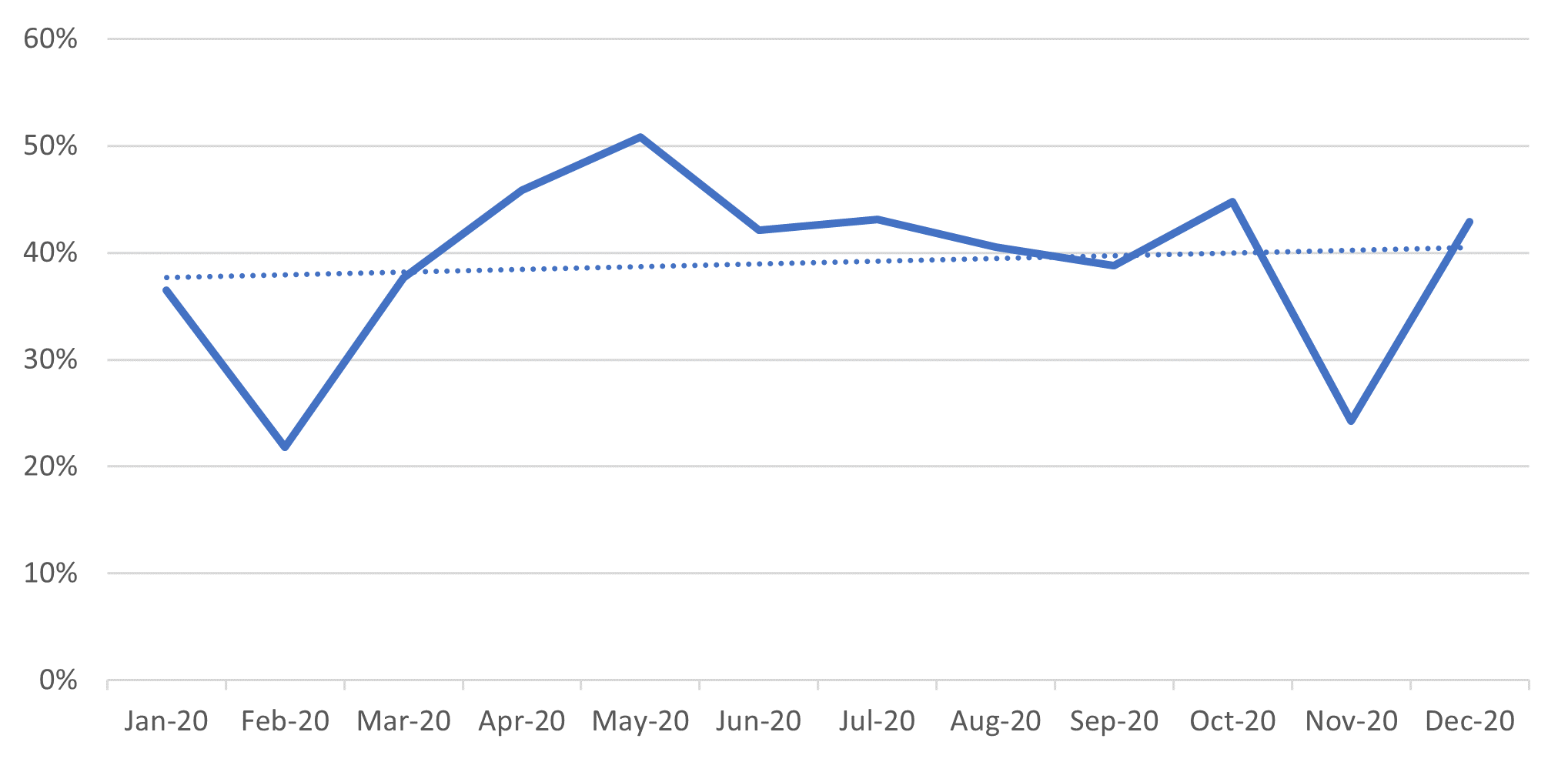

The other side of the coin is the proportion of deal value that is subject to time or performance-based conditions. For this analysis, we examined the split between upfront and deferred/contingent payments within the same dataset.

The mean percentage deferred/contingent within this sample ranged from 22% to 51%. As the year progressed, the proportion of future consideration trended marginally higher.

Chart 2: UK M&A 2020 – % of deal value represented by deferred and/or contingent consideration

As a broad rule of thumb, it appears that there is something of a 40:40 rule, in that approximately 40% of our deals comprise some deferred/contingent consideration and, where this is the case, an average of 40% of the deal value is pushed into the future.

Naturally, the timings of deferred payment and the conditions around contingent payments will vary from deal to deal. Unlike the BNPL credit providers, the vendors of companies will not be contractually due their payments if the goods are not up to scratch.

HOW WILL DEAL STRUCTURING LOOK IN 2021?

Regarding the outlook for deal structuring into 2021, MarktoMarket spoke to Lee Humble of MHA Tait Walker Corporate Finance, who made the following comments:

“The use of deferred or target-based consideration has been commonplace in M&A for some time and I expect this to become increasingly popular as 2021 progresses. All businesses are likely to have shown volatility in performance, and with that volatility we are seeing buyers and funders deepen their diligence processes with a view to establishing and quantifying any movement in risk which the target acquisition may bring. This can work both ways with those industries facing “hard COVID” and lockdown-related circumstances keen to barter prices based on historic results, and those “COVID operators” seeing a large expansion in their business keen to sell on current and future performance.

“Funders are central to this too, with debt appetite across the high street and second-tier lenders largely compressed and unlikely to revert in the short term. This will inevitably lead to increasing use of vendor finance which will take the form of deferred payments. Intertwining with this will be the good old valuation equation – with transactions pitched on a premium basis most likely to see increased use of deferred and target-based profiles.”

For further information or to speak to MarktoMarket please contact olga@marktomarket.io.

Transaction data collected by MarktoMarket is gathered and enriched over time and often relies on estimates. As such, data should be treated on a ‘best estimate basis’ and should not be relied upon. Users of this data assume full responsibility for any references to the data and MarktoMarket has no liability for any damage caused by errors or omissions in any information.

Looking for more interesting tech firms?

Book a free platform tour and see how MarktoMarket helps M&A advisers find fast-growth tech firms