September 2025 UK M&A Valuation Barometer

OVERVIEW

Highlights from our September 2025 Valuation Barometer, covering deals and valuation multiples in UK M&A in August 2025. Request the Executive Summary below.

HIGHLIGHTS

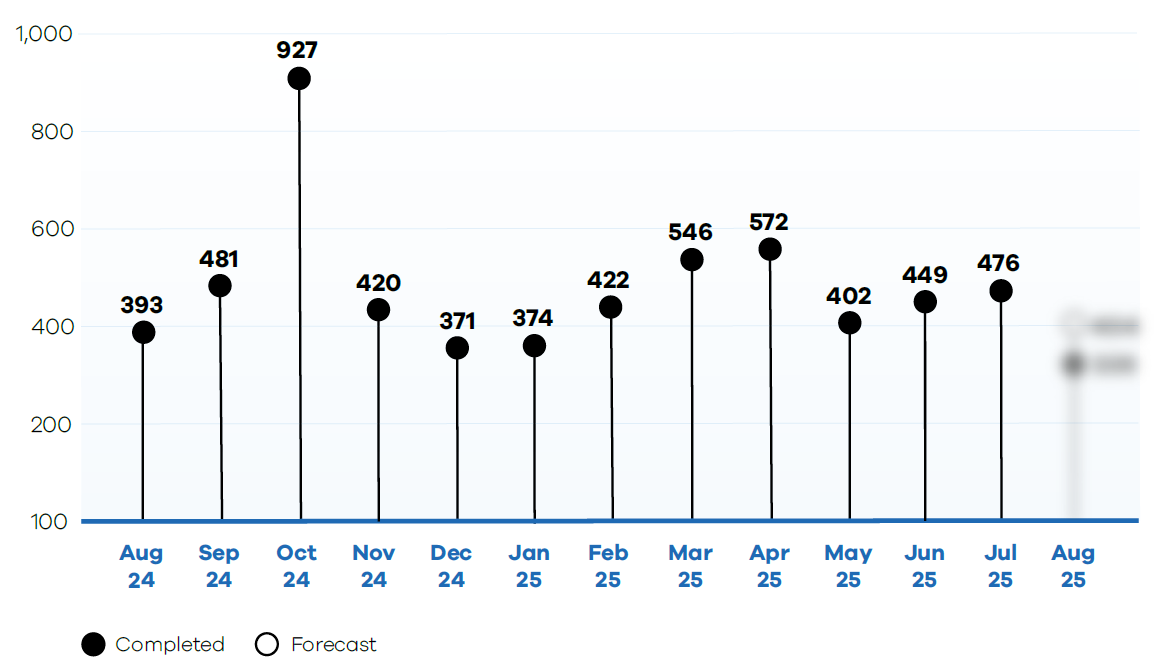

UK M&A activity followed the usual seasonal decline in August 2025, with 339 deal completions recorded as of the publication date.

DEAL COMMENTARY

The largest deal was Centrica PLC’s and Energy Capital Partners LLP’s partnership acquisition of Grain LNG for £1.5 billion.

SPOTLIGHT TRANSACTIONS

Other deals during August included:

- Laumann Group’s acquisition of Epwin Group for £269.9 million.

- APG’s acquisition of seven portfolio investments from Infrastructure PLC for £225 million.

- Sidara’s acquisition of John Wood Group PLC for £216 million.

The smaller end of the market witnessed the following deals:

- Carlyle’s acquisition of intelliflo for £148.3 million.

- A consortium of Israeli institutional investors’ acquisition of Gett for £139 million.

- Halma PLC’s acquisition of Browline N.V., for £129 million.

Request the executive report below. Please contact doug@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous Barometers – visit our reports page.

Request the Report

Submit the form for the executive report.