October 2024 UK M&A Valuation Barometer

OVERVIEW

Highlights from our October 2024 Valuation Barometer, covering deals and valuation multiples in UK M&A in September 2024. Request the Executive Summary below.

HIGHLIGHTS

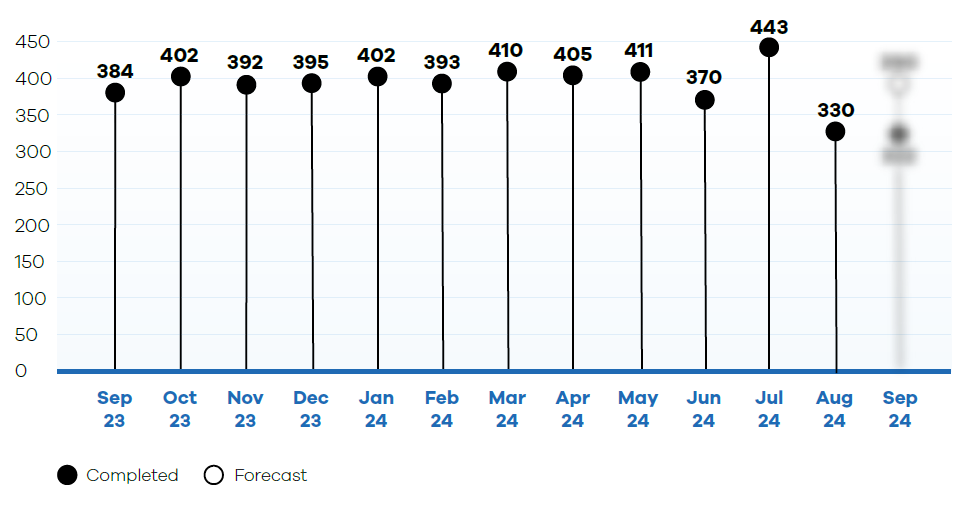

Based on our estimation, September UK M&A activity is expected to reach approximately 390 transactions, which marks an upturn from the previous month, and is broadly in-line with the prior year comparison..

DEAL COMMENTARY

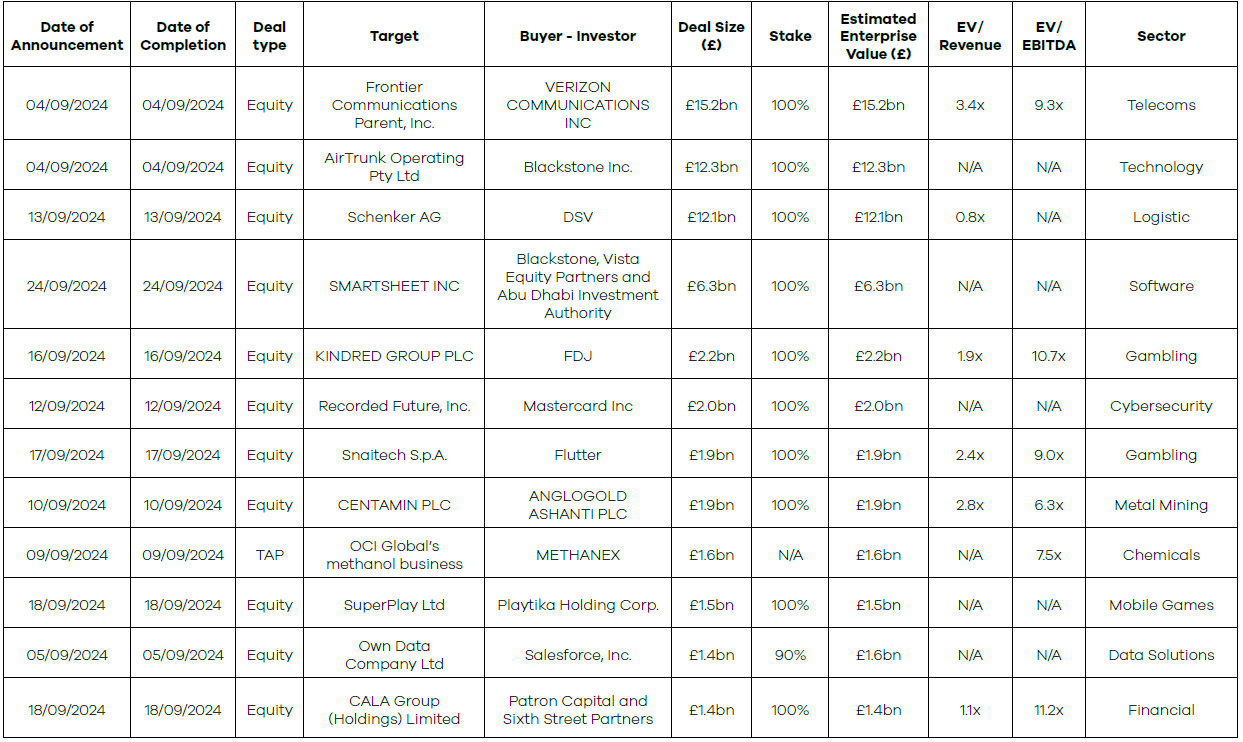

The largest deal in August was Verizon Communications Inc’s acquisition of Frontier Communications Parent, Inc for £15.2bn

SPOTLIGHT TRANSACTIONS

Other deals during September included:

- Visa Inc’s acquisition of Featurespace for £730 million.

- NewRiver REIT Plc’s debt acquisition of Capital & Regional PLC for £335 million (£147 million in consideration)

- Phillips Medisize acquisition of Vectura Group for £298 million.

The smaller end of the market witnessed the following deals:

- Mainsail Partners’ capital investment into MirrorWeb for £48.1 million.

- Johnson Service Group’s acquisition of Empire Linen Services for £20.6 million.

- Anpario plc’s acquisition of Bio-Vet, Inc. for £5.57 million.

SAMPLE COMPLETED AND ANNOUNCED M&A MULTIPLES – September 2024

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous Barometers – visit our reports page

Request the Report

Submit the form for the executive report.