October 2022 Valuation Barometer

OVERVIEW

Highlights from our October 2022 Valuation Barometer, covering deals and valuation multiples in UK M&A in September 2022. Request the Executive Summary below.

HIGHLIGHTS

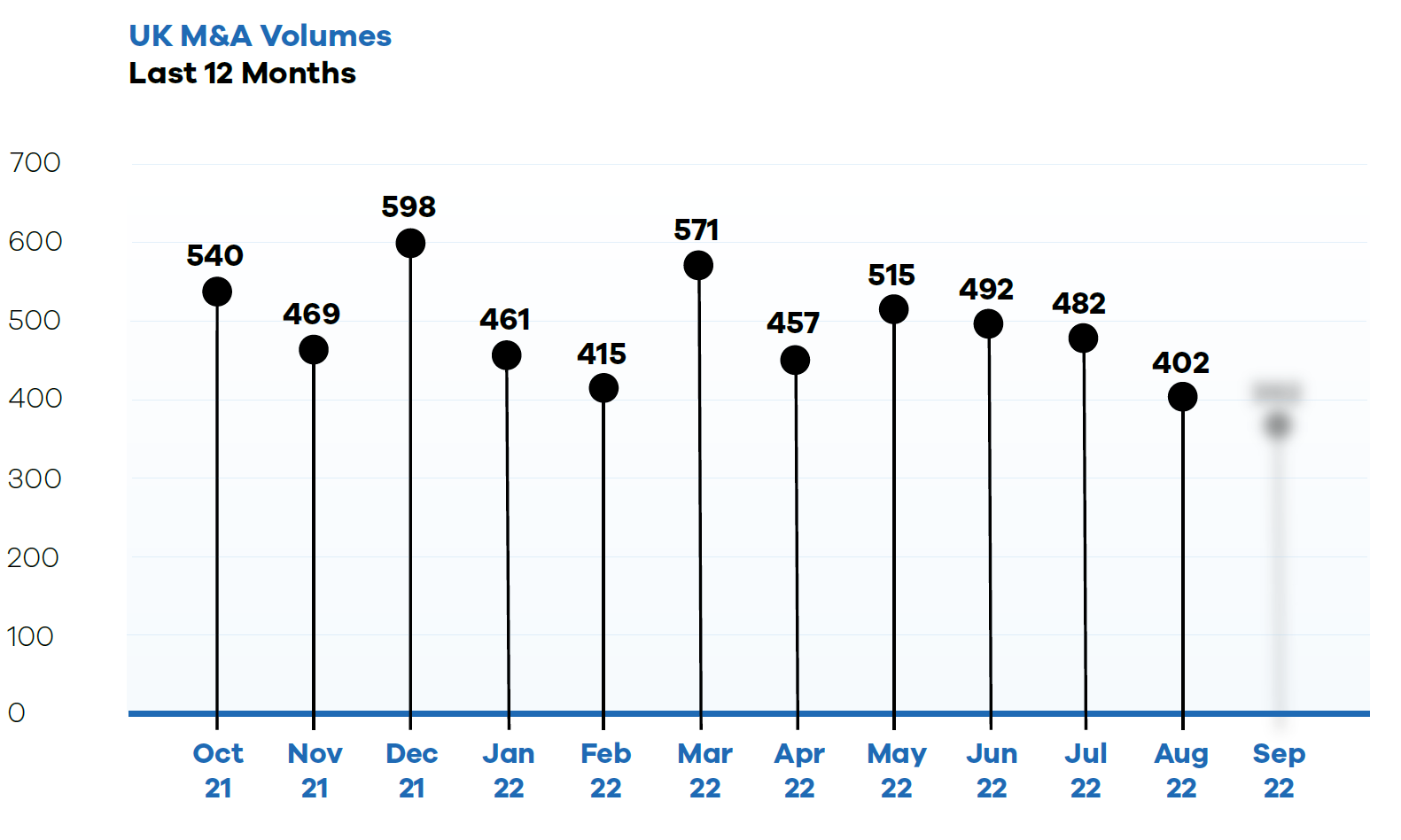

Deal volumes in September 2022 were on par with August 2022 but slightly lower than volumes observed in the first half of 2022.

We combined data from MarktoMarket’s platform and our other sources to estimate the value of deals completed and announced in September 2022. We calculated that M&A deals valued at a total of £25.6 billion were executed or announced during the month.

DEAL COMMENTARY

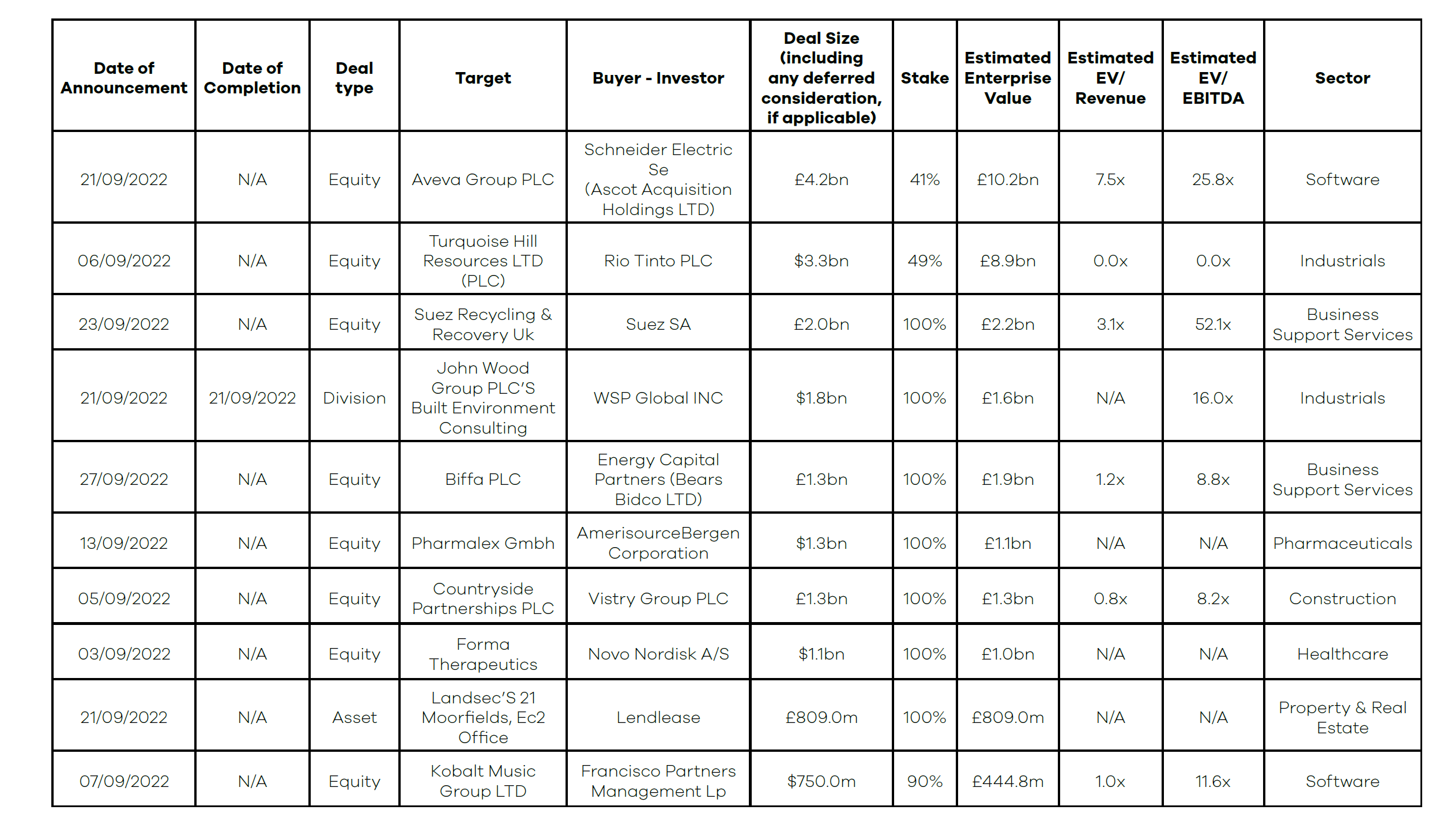

The largest deal was Schneider Electric’s acquisition of Aveva Group PLC at an enterprise

value of £10.2 billion. Already owning a stake of 60%, this step acquisition results in 100% ownership of the British industrial and engineering software business by the French conglomerate, having purchased a controlling stake in 2018. Under the take-private deal,

Schneider will look to expedite decision-making, increase R&D investment and accelerate Aveva’s evolution to a subscription business model.

SPOTLIGHT TRANSACTIONS

Other deals during September included:

- Following Macquarie’s deal with Veolia to acquire Suez UK in August, Suez group has now taken up its right of first refusal, buying back Suez UK for £2 billion.

- WSP Global, Inc acquired British multinational engineering and consulting business, Wood, for $1.8 billion.

- Energy Capital Partners (ECP) has announced the acquisition of Biffa PLC for £1.3 billion.

- Private Equity firm Francisco Partners Management has acquired a controlling interest in Kobalt Music Group for £750 million.

- Access Paysuite is acquiring Pay360 from Capita PLC for £150 million.

The smaller end of the market witnessed the following deals:

- More Acquisitions PLC acquired Megasteel for £49.5 million

- New Wave Group AB acquired B.T.C Activewear for £33 million.

- The disposal of a 3% in Mone Brothers Group Ltd at an estimated enterprise value of £6.9 million.

SAMPLE COMPLETED AND ANNOUNCED M&A MULTIPLES – September 2022

Request the executive report below. Please contact nick.webb@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous 2021 / 2022 Barometers – visit our reports page.

Request the Report

Submit the form for the executive report.