November 2025 UK M&A Valuation Barometer

OVERVIEW

Highlights from our November 2025 Valuation Barometer, covering deals and valuation multiples in UK M&A in October 2025. Request the Executive Summary below.

HIGHLIGHTS

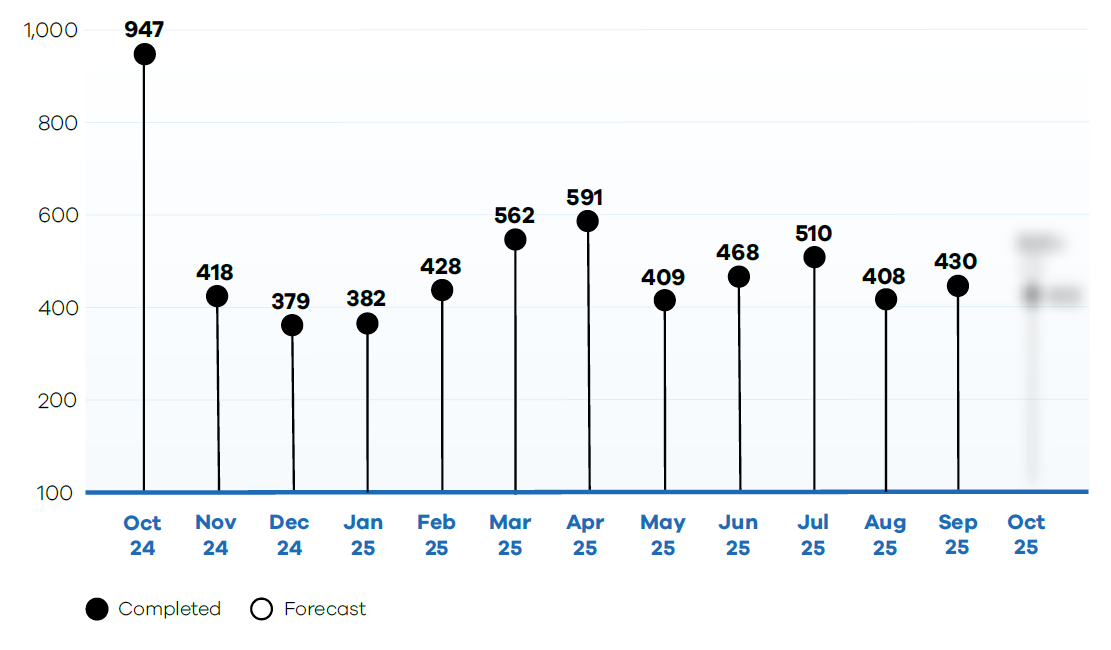

As of the publication date, 422 UK M&A deals were announced in October 2025. In addition to the most up-to-date figure at the time of publication, we also report an estimated total for the month, which includes a provision for deals completed during the month but not reported until after the report cut-off date.

DEAL COMMENTARY

The largest deal was Molex’s acquisition of Smiths Group’s interconnect division for £1.3 billion.

SPOTLIGHT TRANSACTIONS

Other deals during October included:

- Barclays PLC’s acquisition of Best Egg for £603 million.

- Long Path’s acquisition of Idox for £340 million.

- Vodafone’s acquisition of Skaylink for £154 million.

The smaller end of the market witnessed the following deals:

- Stellanor Datacenters Group’s acquisition of Redcentric PLC for £127 million.

- Vestum’s acquisition of Dynamic Fluid Solutions for £31 million.

- Renew Holding’s acquisition of Emerald Power for £12.3 million.

Request the executive report below. Please contact doug@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous Barometers – visit our reports page.

Request the Report

Submit the form for the executive report.