November Valuation Barometer

Overview

Highlights from our November Valuation Barometer, covering deals and valuation multiples in UK M&A from October 2020. Download the full report below.

Highlights

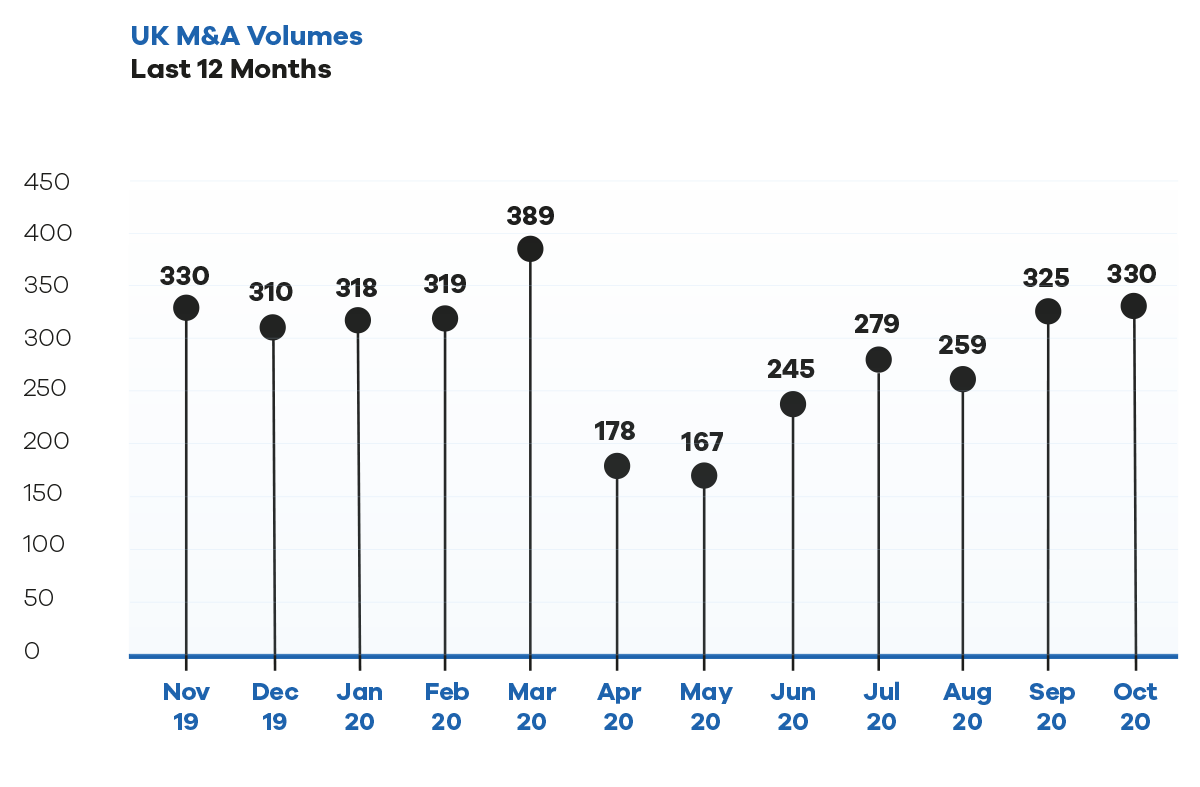

With a $40 billion mega-deal announced last month, September was going to be a hard act to follow. However, acquisitive corporates, infrastructure investors and private equity all gave it a good shot, contributing to a total deal value in the month of a creditable £30.0 billion.

Several multi-billion pound transactions were announced, including: Walmart’s sale of Asda to the Issa brothers and TDR Capital; LSE’s disposal of Borsa Italiana (the Italian Stock Exchange) to Euronext; and Liberty Global’s acquisition of Swiss telecoms challenger Sunrise Communications. The deal total of 330 was ahead of a September comparable of 325,

representing a return to ‘normalised’ pre-COVID levels of activity.

Spotlight Transactions

Material deals during October included:

- The London Stock Exchange’s sale of Borsa Italiana to Euronext NV for €4.3 billion

- Oleg Novachuk and Vladimir Kim’s £3 billion bid for copper miner Kaz Minerals

- The proposed takeover of TalkTalk Telecom by Toscafund

The smaller end of the market also announced some interesting transactions

- Advanced Business Software and Solutions’ acquisition of Clear Review, a performance management SaaS offering, for £26 million

- The sale of IT-IS International, a developer and manufacturer of diagnostic instrumentation, to Novacyt for up to £12 million.

- Care home provider CareTech’s acquisition of Smartbox Assistive Technology, a provider of communication aids for the elderly and vulnerable, for £10.6 million

- The sale of haulier Nidd Transport to Xpediator for £4.6 million

dEAL cOMMENTARY

Within smaller company deal making, Judges Scientific returned to the fold with the acquisition of chemical vapour deposition specialist Korvus – a positive signal from one of the most active acquirers in the industrials space over recent years.

Additionally, small businesses in the Financial Services and Fintech sectors proved popular, with a host of deals that included: MJ Hudson’s acquisition of Bridge Consulting; the sale of Watchstone’s Ingenie business to A-Plan Group; Somerset Capital Management’s takeover of Liontrust’s Asia Income Team and Fund; and Equals Group’s ‘trade and asset’ deal for the international payments business of Effective FX. Within the technology sector, video companies remained attractive to acquirers – October saw the acquisitions of Coastlink Software and Deus Craft.

Read our latest article about video game company acquisitions.

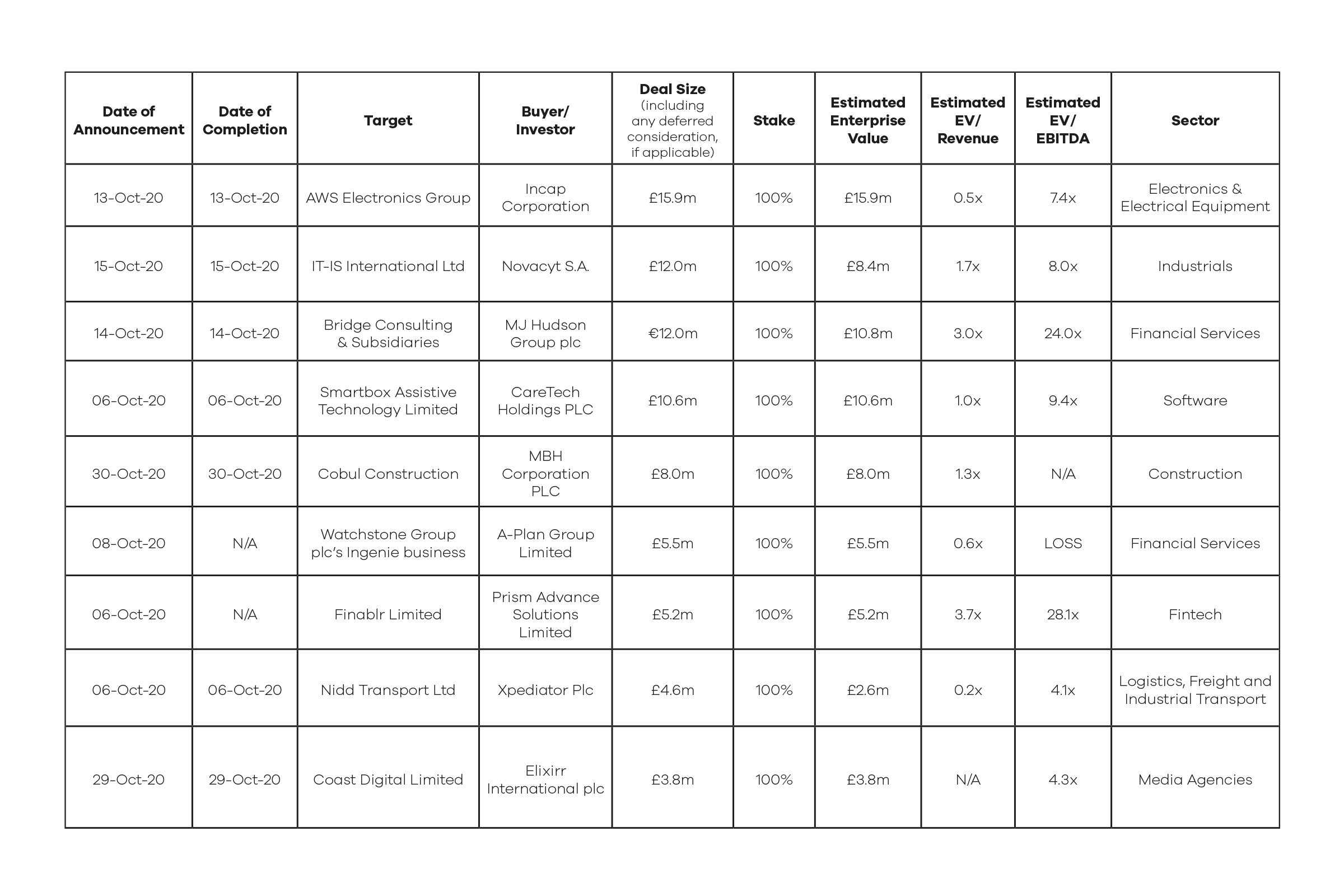

sAMPLE COMPLETED AND ANNOUNCED m&a MULTIPLES – OCTOBER 2020

Download the executive report below. Access to the full list of deals in the November Valuation Barometer is reserved for members of the MarktoMarket Data Co-operative.

For the full list of previous 2020 Barometers – visit our reports page.

Download the November Barometer

Submit the form for the executive report.