May 2021 Valuation Barometer

Overview

Highlights from our May ’21 Valuation Barometer, covering deals and valuation multiples in UK M&A in April 2021. Request the Executive Summary below.

Highlights

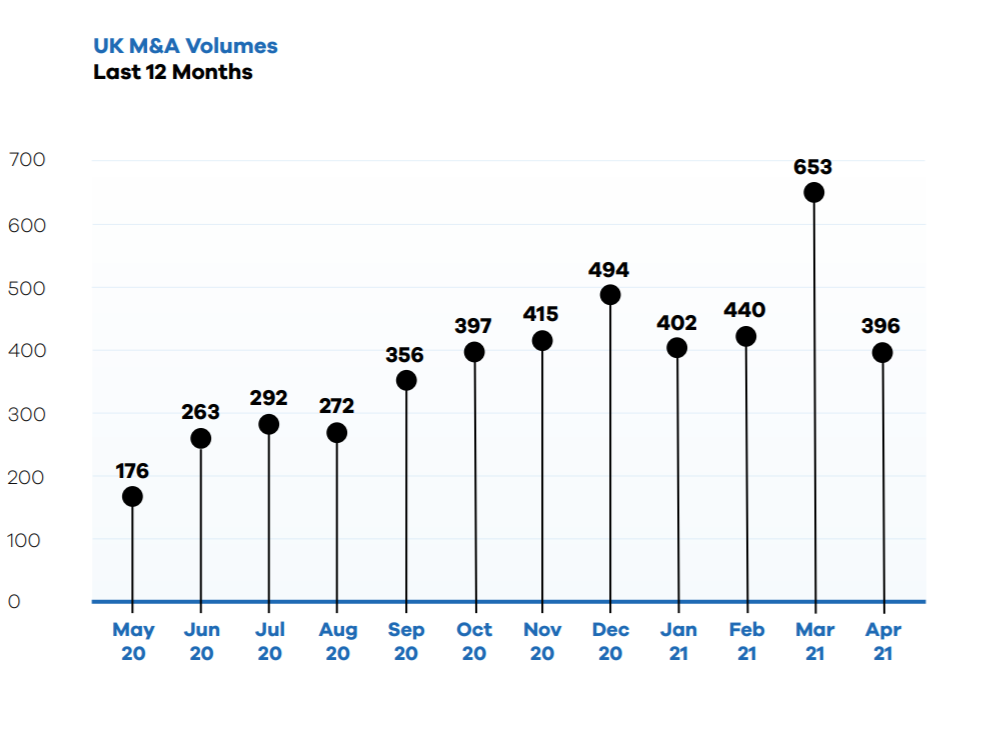

After witnessing extraordinary levels of M&A activity in March, the month of April ‘normalised’ with 396 M&A transactions recorded (39% lower than March 2021).

One of the largest transactions was Melrose Industries’ disposal of Nortek Air Management, its data centre cooling supplier business, to Madison Industries for approximately £2.6 billion. At the smaller end of the corporate universe the financial services sector was busy with a number of deals including the disposal of RBS-owned private bank Adam & Co to Canadian wealth manager Canaccord Genuity for £54 million.

We calculated that M&A deals valued at a total of £12.5 billion were executed or announced during the month, 66% lower than March 2021.

dEAL cOMMENTARY

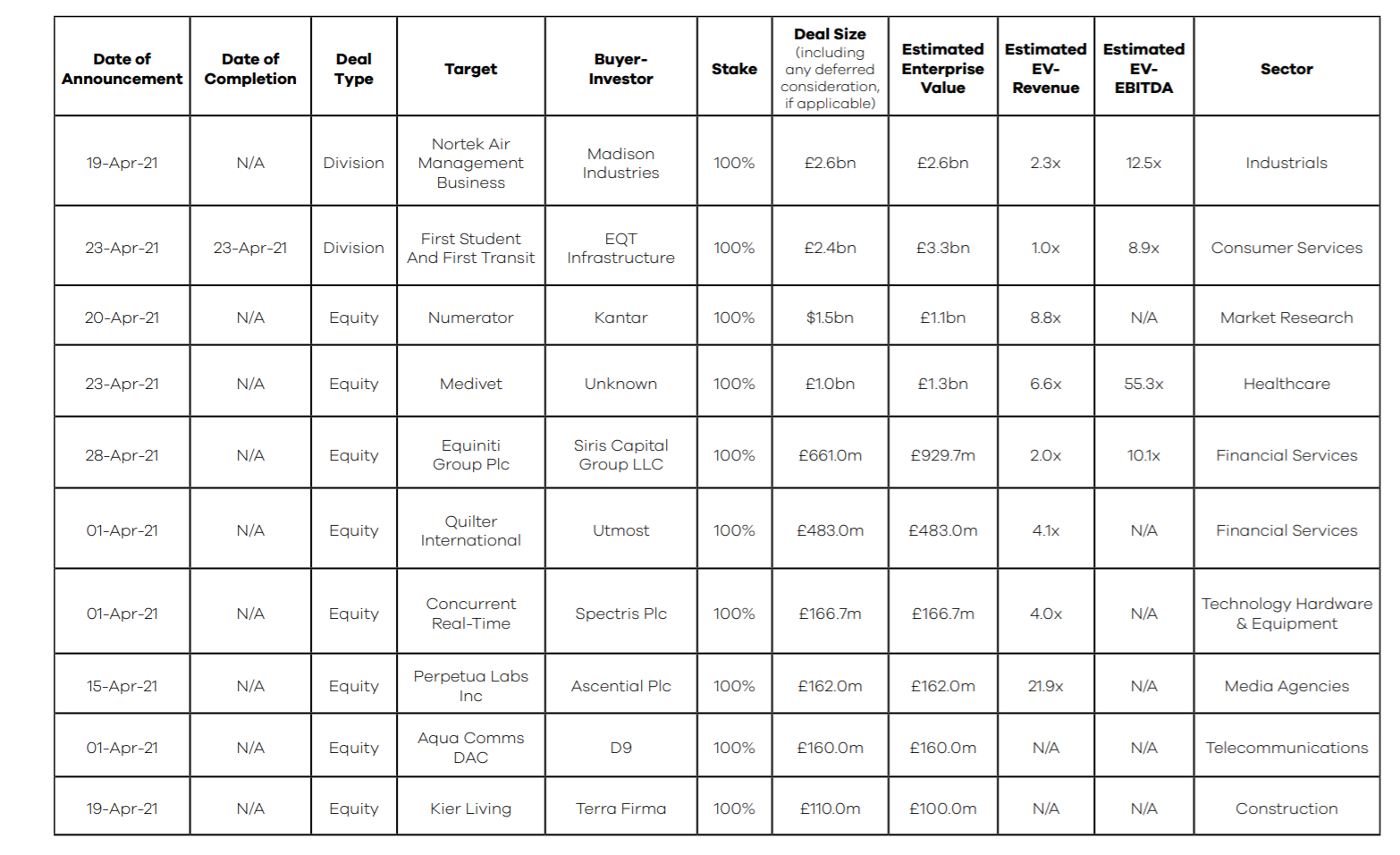

In April we recorded 4 deal values over £1 billion, including Melrose Industries’ disposal of Nortek Air Management, its data centre cooling supplier business, to Madison Industries for approximately £2.6 billion. Another UK plc, FirstGroup, exited its North American subsidiaries through the sale of First Student and First Transit, the operators of transportation services to schools and communities, for $4.6 billion to private equity and infrastructure group EQT.

Spotlight Transactions

Other deals during April included:

- Kantar’s $1.5 billion acquisition of Numerator, a provider of market analysis and consumer insight

- FirstGroup, wich exited its North American subsidiaries through the sale of First Student and First Transit, the operators of transportation services to schools and communities, for $4.6 billion to private equity and infrastructure group EQT

- Cartena Group’s acquisition of 89.9% of Insight, an artificial intelligence solution for financial

analysis, for £27.9 million

The smaller end of the market witnessed the following deals:

- Mattioli Woods acquisitions of financial planner Pole Arnold for £7 million and asset manager Caledonia for £1.6 million

- The sale of digital pharmacist RX Live to Claren Energy Corp of Canada for CAD$15 million

- The acquisition of ExtraMed, the provider of patient flow software, to Australian IT services provider Alcidion for £5.3 million

sAMPLE COMPLETED AND ANNOUNCED m&a MULTIPLES – april 2021

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous 2020 / 2021 Barometers – visit our reports page.

Request the May 2021 Barometer

Submit the form for the executive report.