March 2025 UK M&A Valuation Barometer

Category:

Market Report

OVERVIEW

Highlights from our March 2025 Valuation Barometer, covering deals and valuation multiples in UK M&A in February 2025. Request the Executive Summary below.

HIGHLIGHTS

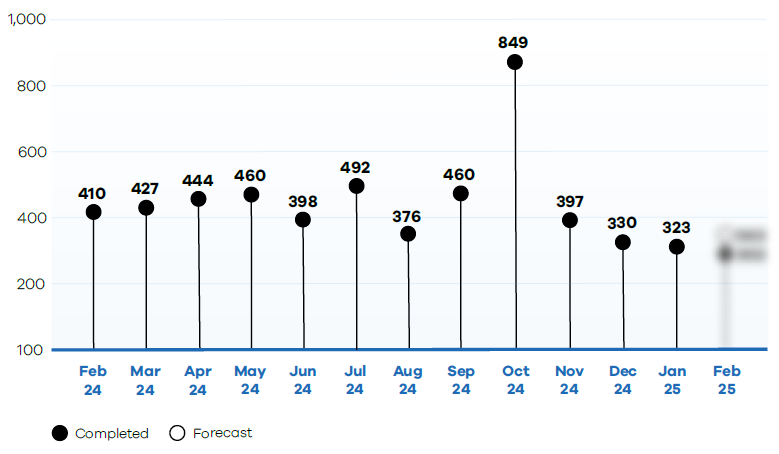

There was a fall in the number of deals completed in February, relative to previous months.

DEAL COMMENTARY

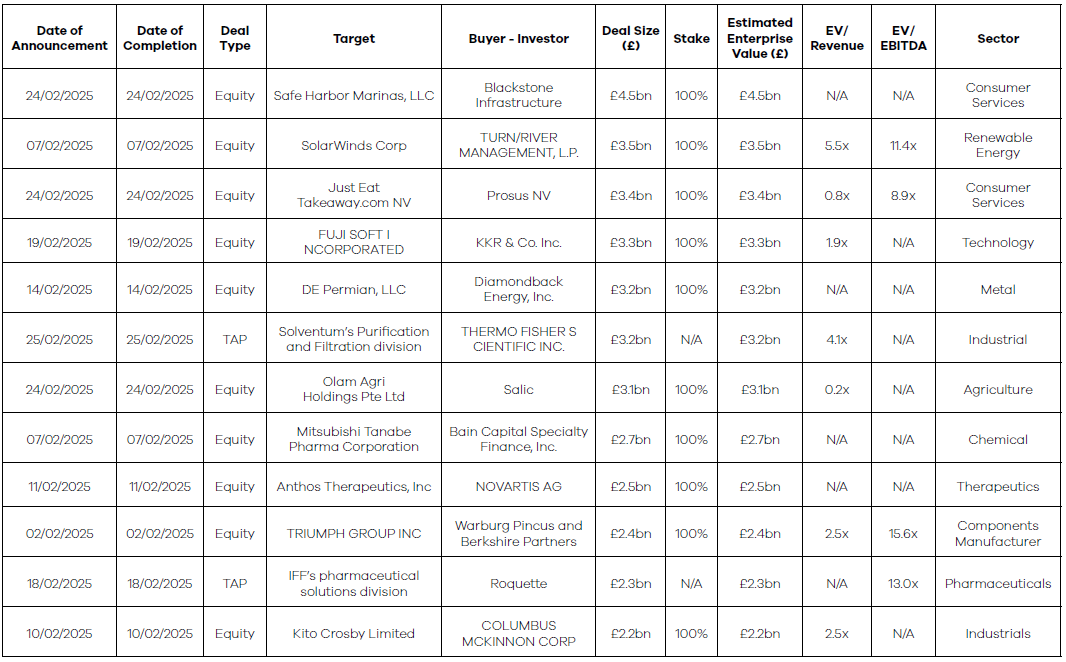

The largest deal in February was Blackstone Infrastructure’s acquisition of Safe Harbor Marinas LLC for £4.5bn.

SPOTLIGHT TRANSACTIONS

Other deals during February included:

- MMC Singapore Resources’ acquisition of Anglo American for £397 million.

- Montagu’s acquisition of Multifonds for £323 million.

- UPM Raflatac’s acquisition of Metamark for £146 million.

The smaller end of the market witnessed the following deals:

- AstraZeneca PLC’s acquisition of FibroGen for £67 million.

- XPS Pensions Group’s acquisition of Polaris Actuaries for £58.4 million.

- Checkit PLC’s acquisition of Crimson Tide for £6.5 million.

SAMPLE COMPLETED AND ANNOUNCED M&A MULTIPLES – February 2025

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous Barometers – visit our reports page

Request the Report

Submit the form for the executive report.