January 2021 Valuation Barometer

Overview

Highlights from our January ’21 Valuation Barometer, covering deals and valuation multiples in UK M&A in December 2020. Download the report below.

Highlights

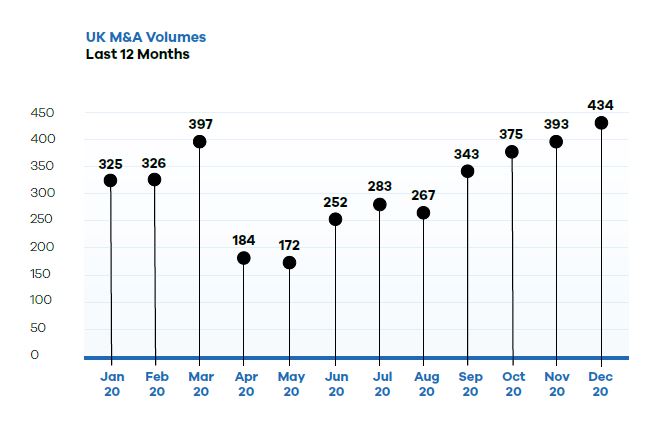

Strong deal momentum continued into December with data suggesting a busy end of the year. 434 M&A transactions completed in December (10% ahead of November), with customers reporting strong pipelines for 2021.

Competition for assets in attractive sectors continued to intensify. At the larger end of the market, Electronics Art made a last-minute winning bid for Codemasters, whilst financial services targets including Dalton and Appian were in favour at the smaller end of the market.

We calculated that M&A deals valued at a total of £76.7 billion were executed or announced during the month. This represents an uplift of 42% on the November 2020 total of £54.2 billion.

dEAL cOMMENTARY

As has been the norm in recent months, a small number of ‘mega deals’ have boosted the deal value figure. In December, it was UK pharma giant AstraZeneca’s $39 billion bid for Boston-based rare disease specialist Alexon. The cash and share deal was not well received by the market, with AstraZeneca’s shares falling 5% following the announcement. Our second largest transaction was the completion of Tesco’s sale of its Thai and Malaysian businesses.

Spotlight Transactions

Other deals during December included:

- The $5.6 billion acquisition of BP’s Alaskan operations by Hillcorp Energy Co.

- A renewed bid for G4S by Allied Universal, valuing the security group at £3.8 billion.

- The acquisition of the remaining 37% of Edinburgh-based US sports betting group FanDuel by Flutter. The deal values FanDuel at $11 billion. We estimate this represents a revenue multiple of 10x, a bargain in comparison to its closest peer, DraftKings, which trades on 36x trailing sales.

The smaller end of the market witnessed the following deals:

- Brickability’s acquisition of McCann, a building materials logistics specialist, for £1.75 million.

- The sale of clean air solutions designer and manufacturer Monmouth Scientific to SDI Group for £5.8 million.

- Schroder’s acquisition of Ombu, an investor in early stage ‘cleantech’ opportunities, for £4 million.

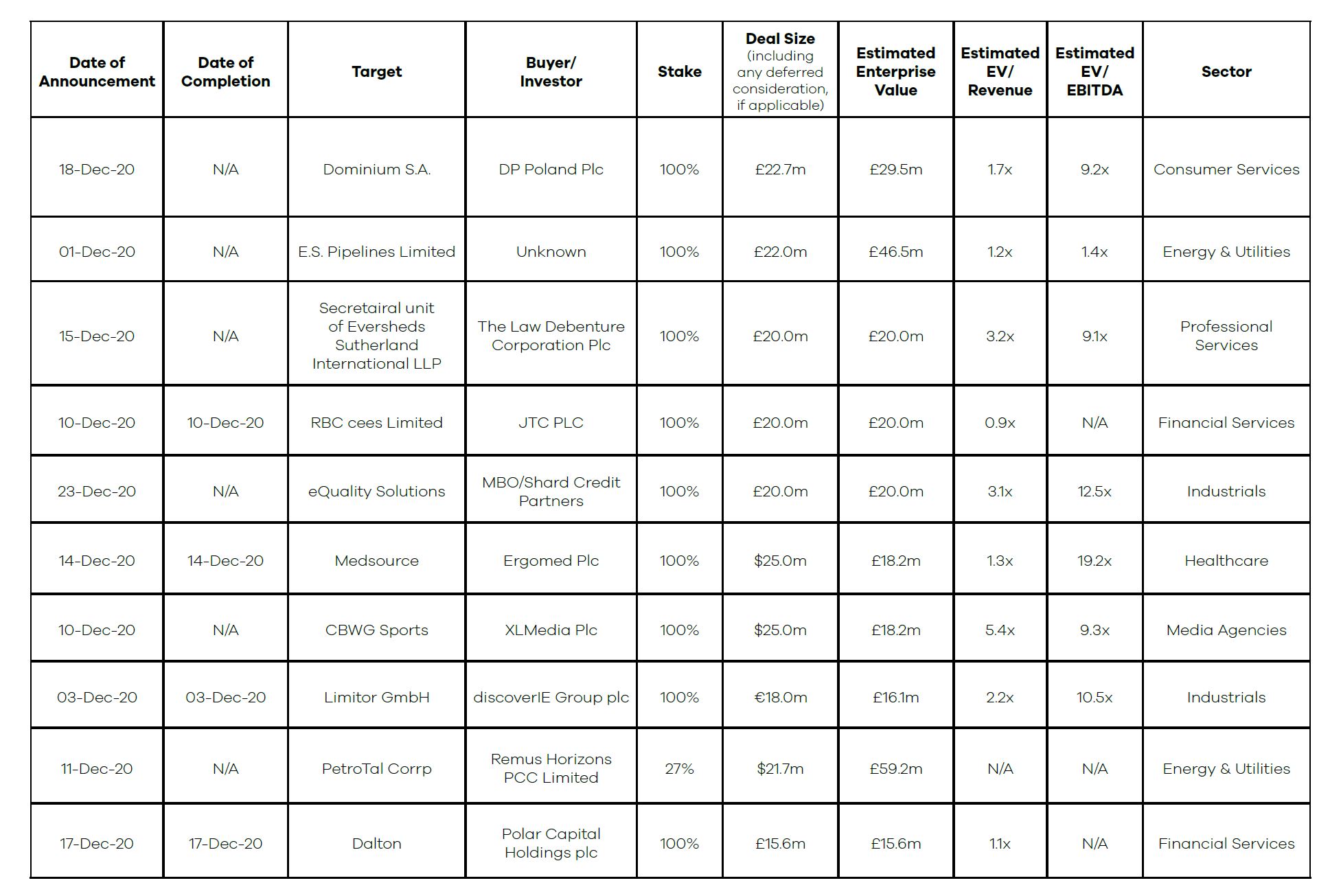

sAMPLE COMPLETED AND ANNOUNCED m&a MULTIPLES – DECEMBER 2020

Download the executive report below. Access to the full list of deals in the Valuation Barometers is reserved for members of the MarktoMarket Data Co-operative.

For the full list of previous 2020 Barometers – visit our reports page.

Download the January 2021 Barometer

Submit the form for the executive report.