December 2024 UK M&A Valuation Barometer

OVERVIEW

Highlights from our December 2024 Valuation Barometer, covering deals and valuation multiples in UK M&A in November 2024. Request the Executive Summary below.

HIGHLIGHTS

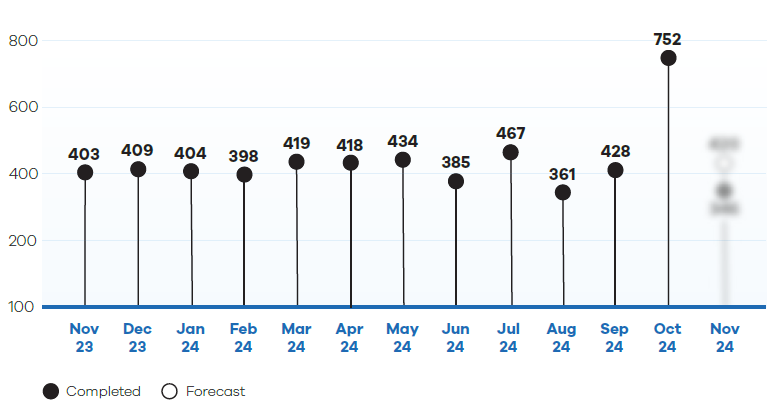

After exceptional levels of activity in the run-up to the Autumn Budget in October, UK M&A activity returned to normal levels in November.

DEAL COMMENTARY

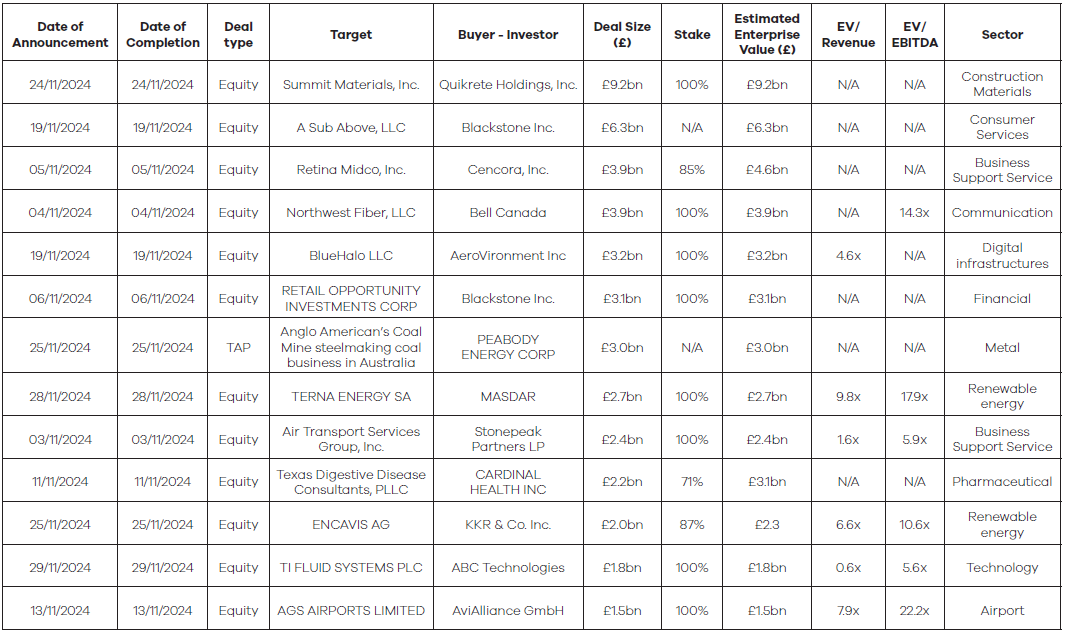

The largest deal in November was Quikrete Holdings, Inc’s acquisition of Summit Materials Inc for £9.2bn.

SPOTLIGHT TRANSACTIONS

Other deals during November included:

- Apax Partners advisory on the disposal of Evelyn Partners’ accounting assets to multiple funds for £700 million.

- Compass Group’s acquisition of 4Service for $500 million.

- Novo Holdings’ acquisition of Benchmark Genetics for £260 million.

The smaller end of the market witnessed the following deals:

- Steadfast Group’s acquisition of H.W Wood for £23.5 million

- Vesuvius PLC’s acquisition of Piromet AS for £21.9 million for a 61.65% stake.

- Water Intelligence PLC’s re-acquisition of its Dallas franchise American Leak Detection for £16 million.

SAMPLE COMPLETED AND ANNOUNCED M&A MULTIPLES – November 2024

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous Barometers – visit our reports page

Request the Report

Submit the form for the executive report.