February 2026 UK M&A Valuation Barometer

OVERVIEW

Highlights from our February 2026 Valuation Barometer, covering deals and valuation multiples in UK M&A in January 2026. Request the Executive Summary below.

HIGHLIGHTS

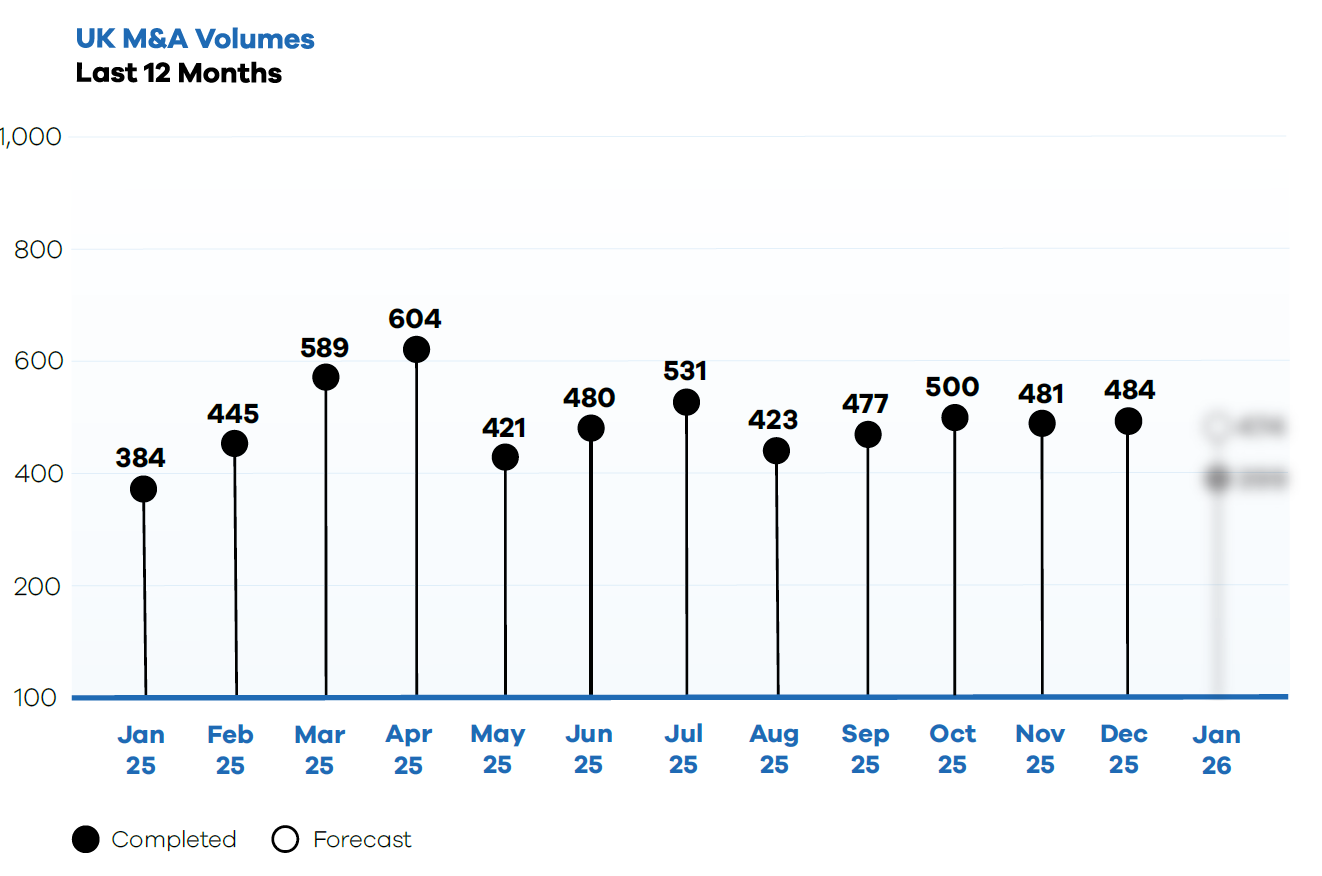

As of the publication date, 399 UK M&A deals were announced in January 2026. In addition to the most up-to-date figure at the time of publication, we also report an estimated total for the month, which includes a provision for deals completed during the month but not reported until after the report cut-off date.

DEAL COMMENTARY

The largest deal was Hg Capital’s acquisition of OneStream for £4.7 billion.

SPOTLIGHT TRANSACTIONS

Other deals during January included:

- Bridgepoint’s acquisition of Interpath Advisory for £800 million.

- TDR Capital’s acquisition of Escode (part of NCC Group) for £275 million.

- One Equity Partners Capital Advisers’ acquisition of Kitwave for £368 million.

The smaller end of the market witnessed the following deals:

- VertiGIS’s acquisition of 1Spatial PLC for £87.1 million.

- Future PLC’s acquisition of SheerLuxe for £40 million.

- Drax’s acquisition of Flexitricity for £36 million.

- Fintel PLC’s acquisition of Pearson Ham for £11 million.

Request the executive report below. Please contact kathryn.stevenson@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous Barometers – visit our reports page.

Request the Report

Submit the form for the executive report.