UK M&A Valuation Indices 2025

Report Highlights

Highlights from our 2025 UK M&A Valuation Indices, covering UK M&A transaction multiples for M&A deals completed in 2025.

Indices Commentary

M&A valuations in 2025 suggest a more cautious environment. Our All Cap index registered a fall from a median EV/ EBITDA multiple of 6.5x in 2024 to 6.1x in 2025. Customers tell us that geopolitical uncertainty, tariff tensions, and AI-related workforce changes have contributed to buyer nervousness, which has fed-through to valuations. Whilst the year-on-year picture is negative, the 2025 figure was back in-line with our 2023 All-Cap multiple.

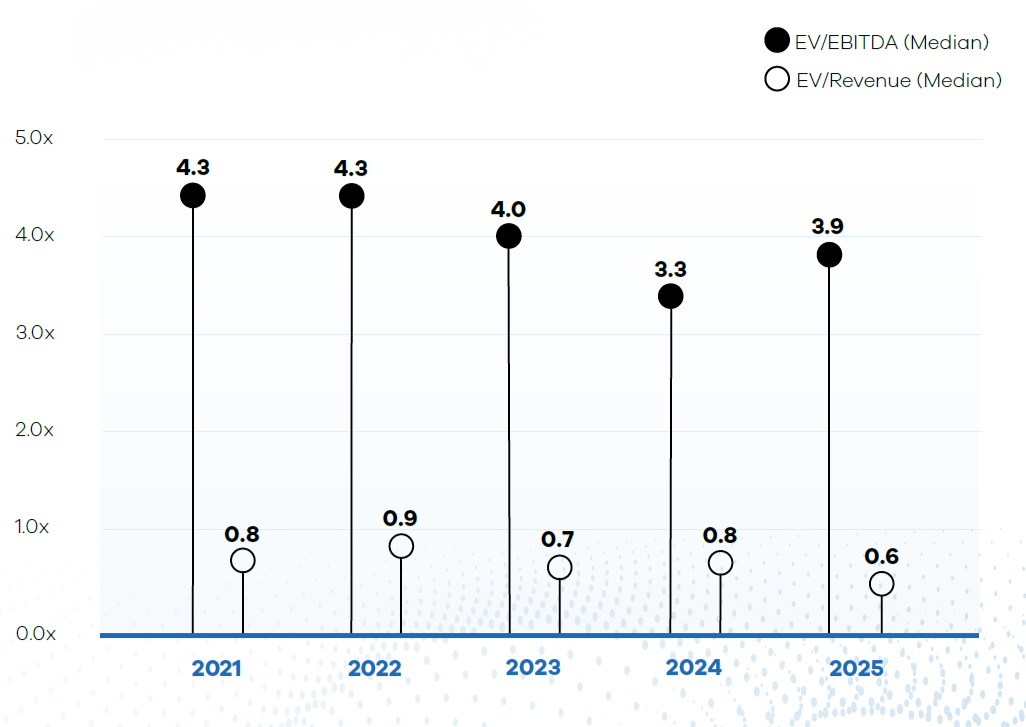

Figure 1: MarktoMarket Nano Cap Index EV/EBITDA (Median)

The Nano Cap index, which consists of M&A transactions valued at under £2.5m, is designed to be representative of the smallest companies in the UK.

Our provisional data suggests that Nano-Cap multiples improved slightly in 2025, with a median EV/EBITDA of 3.9x, up from 3.3x in 2024. However, valuations remain some way below the highs of 2021 and 2022, when median multiples were 4.3x.

SECTOR-BASED INDICES

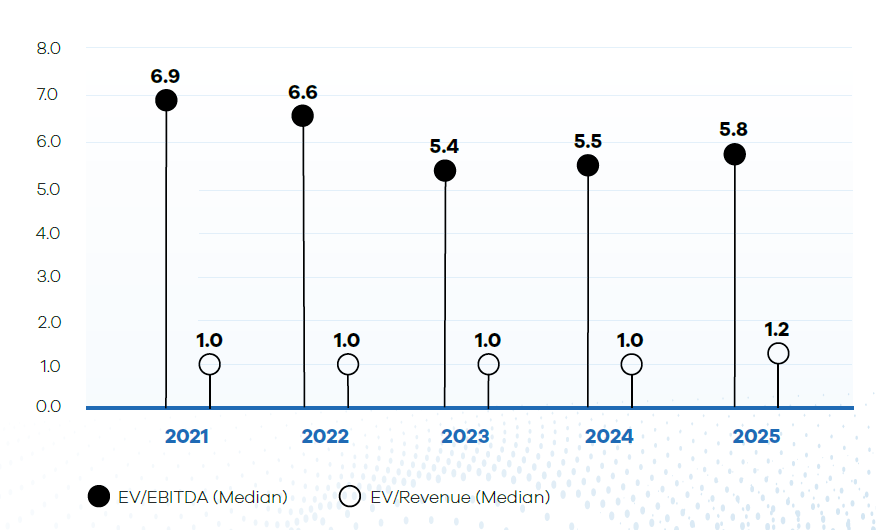

Figure 2: MarktoMarket Industrials & Business Support Services Index

Valuations improved in the I&BSS sector in 2025. The median EBITDA multiple expanded modestly from 5.5x to 5.8x.

*see the full report for our definition of outliers.

Request the executive report below. Please contact kathryn.stevenson@marktomarket.io to discuss access to the full versions of all MarktoMarket Reports.

For the full list of previous reports visit our reports page.

Request the Report

Submit the form for the executive report.