January 2025 UK M&A Valuation Barometer

Category:

Market Report

OVERVIEW

Highlights from our January 2025 Valuation Barometer, covering deals and valuation multiples in UK M&A in December 2024. Request the Executive Summary below.

HIGHLIGHTS

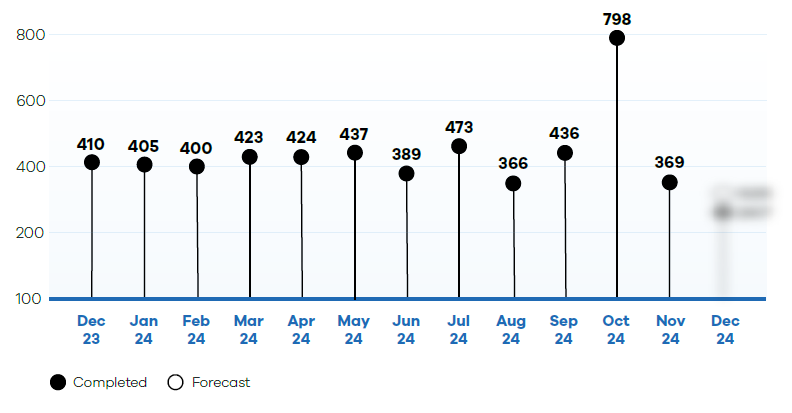

There was a fall in the number of deals completed in December relative to previous months, reflecting the typical year-end slowdown.

DEAL COMMENTARY

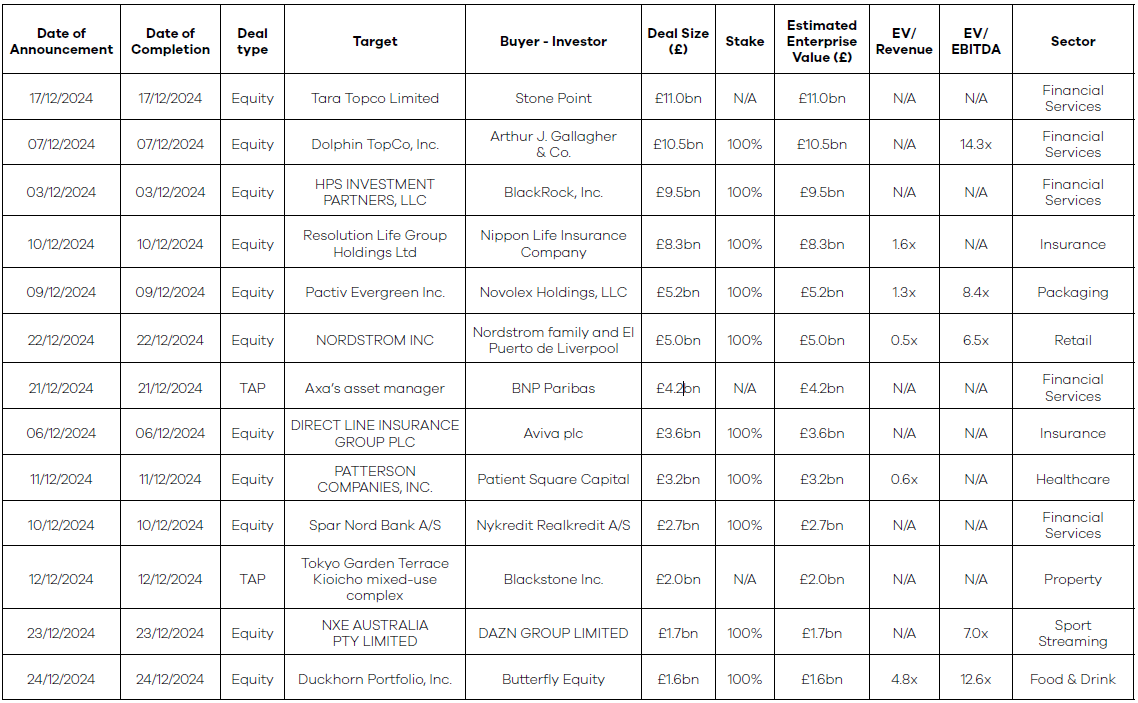

The largest deal in December was Stone Point’s acquisition of Tara Topco Limited for £11bn.

SPOTLIGHT TRANSACTIONS

Other deals during December included:

- Triton’s acquisition of Bosch’s security and communications business for £577 million.

- Intermediate Capital Group’s acquisition of Lomond for £450 million.

- JC Flowers Funds, TowerBrook Funds, and Railsr shareholders’ shared acquisition of Equals Group for £283 million.

The smaller end of the market witnessed the following deals:

- Animalcare Group’s acquisition of Randlab for £62 million.

- Media Concierge’s acquisition of National World for £65 million.

- Card Factory PLC’s acquisition of its Garven Holdings for £20 million.

SAMPLE COMPLETED AND ANNOUNCED M&A MULTIPLES – December 2024

Request the executive report below. Please contact olga@marktomarket.io to discuss access to the full list of deals in the MarktoMarket Valuation Barometers.

For the full list of previous Barometers – visit our reports page

Request the Report

Submit the form for the executive report.